Brazil is one of the biggest markets for traders in Latin America. On the country’s main exchange, B3 (Brasil Bolsa Balcão), millions of people already trade stocks, futures, and options. But for many, the next step is joining a prop firm.

A prop firm gives traders company money to trade instead of using their own savings. If you follow the rules and manage risk, you keep most of the profits. For traders in Brazil, this is often the fastest way to move past small retail accounts and trade with real size.

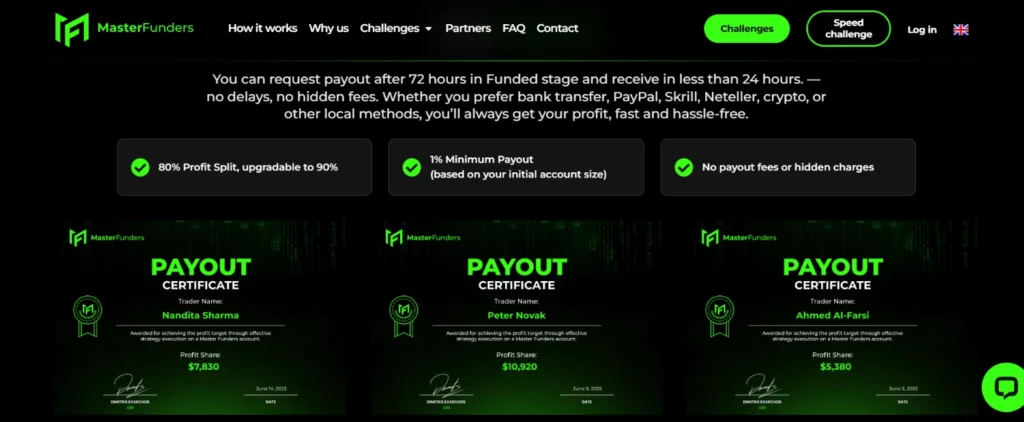

At MasterFunders, you can start with small challenge fees and scale to accounts as large as $200,000. Payouts are processed in as little as 7 days, and profit splits reach up to 90%.

Access to Bigger Trading Capital

The biggest reason Brazilian traders join a prop firm is to get more trading capital. Instead of being limited by your own deposit, the firm provides funds you can trade with. This gives you the power to take larger positions and go after bigger profits.

At MasterFunders, traders in Brazil can choose from account sizes such as:

- $5,000 – Beginner

- $10,000 – Mini

- $25,000 – Starter

- $50,000 – Basic

- $100,000 – Advanced

- $200,000 – Superior

With consistent results, you can scale past $1M in funding.

The entry point is not a large deposit like with a local broker. Instead, you pass a prop trading challenge that checks your skills. Things like profit targets, daily drawdowns, and max loss.

For traders in Brazil who want to grow faster than they could with their own money, prop firms offer a clear path forward.

Support Multiple Trading Strategies

One reason traders in Brazil choose prop firms is the freedom to use different trading styles. Some prefer scalping, others lean toward swing trading or algorithmic strategies with EAs. Many prop firms also support crypto trading, giving traders plenty of ways to apply the approach that fits them best.

This flexibility matters because not every trader succeeds the same way. According to a Finance Magnates report, 80% of traders fail prop firm challenges globally. But South American traders, especially from Brazil, are among the top in participation. That shows how strong the trading culture is here, even when the odds are tough.

At MasterFunders, Brazilian traders can use their own style, as long as they stay within simple risk management rules. This way, discipline and creativity can work together.

Multi-Instrument Trading Access in Brazil

Brazilian traders don’t just stick to one market. That’s why prop firms here support a wide range of assets, including:

- Forex currency pairs

- Global indices

- Metals like gold and silver

- Cryptocurrencies

The growth of Brazil’s local market has been huge. A B3 report shows that derivatives volume went from 3 million contracts per day in 2016 to 25 million per day recently. This puts Brazil among the top 3 markets worldwide that prop firms target.

By combining global markets, prop firms give Brazilian traders more ways to diversify, test strategies, and find consistent profits.

Education & Mentorship

Good trading takes more than just money. It takes learning, practice, and community. That’s why the best prop firms for Brazilian traders also offer education and mentorship.

At MasterFunders, traders can learn through resources, webinars, and active online communities on Discord and Telegram. These groups are where traders share ideas, discuss strategies, and stay motivated.

Most importantly, every trader needs to understand risk management. Without it, even skilled traders can lose their chance to stay funded. That’s why MasterFunders sets clear risk management rules, like daily loss limits, to help traders build discipline and last longer in the markets.

Seamless Onboarding for Brazilian Traders

Getting started with a prop firm in Brazil should be simple. At MasterFunders, traders can choose between three paths:

1-Step Challenge

- Profit Target: 10%

- Daily Drawdown: 4%

- Max Drawdown: 5%

2-Step Challenge

- Phase 1 Profit Target: 10%

- Phase 2 Profit Target: 5%

- Daily Drawdown: 5%

Pass these challenges and you’ll receive a funded account with payouts in as little as 7 days. Strong traders can also scale to larger accounts, even past $1M in funding.

Instant Funding

Don’t want to wait? With instant funding, Brazilian traders can start trading from day one with up to $100,000 in capital. There’s no evaluation or waiting period. Earn just 1% profit and you can withdraw right away. Standard profit split is 80%, with the option to upgrade to 90%. Over time, you can scale to $400,000.

This onboarding process, whether through challenges or instant funding, makes it easier for traders in Brazil to focus on trading instead.

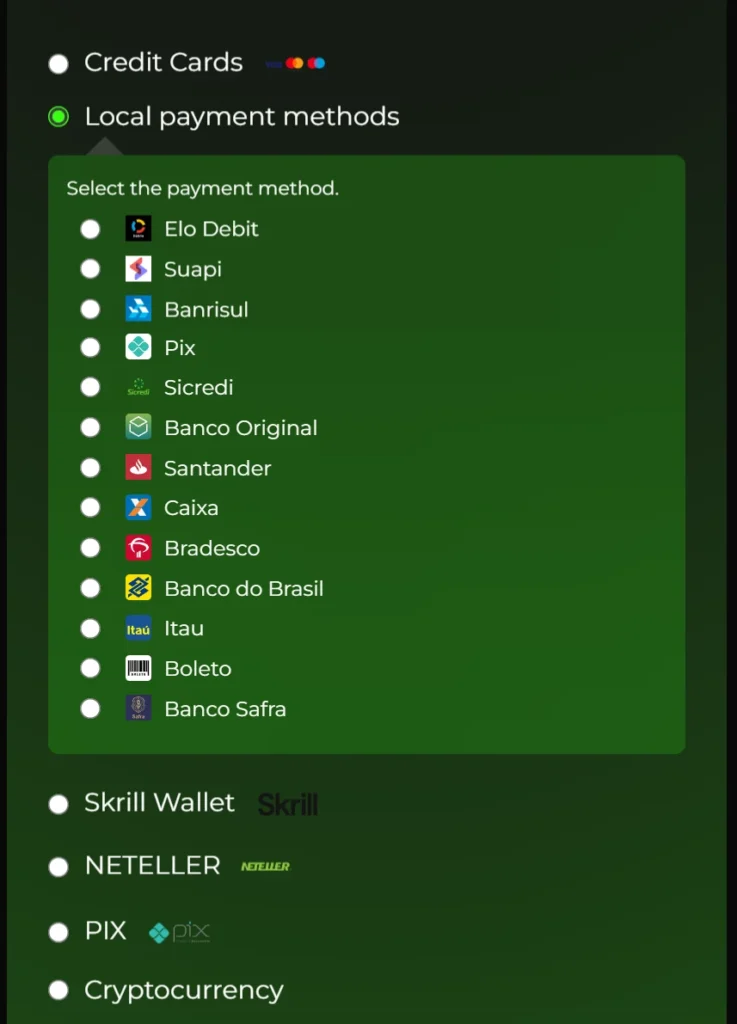

Local Payment Methods for Brazilian Traders

One of the biggest barriers for traders in Brazil is payment access. At MasterFunders, we make it simple by supporting local payment methods that Brazilian traders already use daily.

Available options include:

-

Pix (instant transfers, the most popular payment system in Brazil)

-

Boleto Bancário (traditional payment slip method)

-

Major banks like Bradesco, Itaú, Caixa, Santander, Banco do Brasil, Banco Safra, and Banco Original

-

Regional banks including Banrisul and Sicredi

-

Elo Debit and Suapi cards

-

Plus global options like Skrill, Neteller, and cryptocurrency

This means you can purchase using familiar local systems, without dealing with international transfers.

With Pix and Boleto, traders in Brazil can start their funded journey with MasterFunders faster and more securely.

Regulation & Taxes for Prop Traders in Brazil

Prop trading in Brazil is overseen by the CVM (Securities and Exchange Commission of Brazil). This regulator sets the rules that firms must follow, covering things like licensing, compliance, and transparency.

For traders, taxation depends on residency and the type of asset. In most cases, profits are taxed at 15% to 22.5%. However, since many prop firms operate offshore, Brazilian traders often face simpler structures when they receive payouts from funded accounts.

This setup makes it easier for traders to focus on passing their prop firm challenge and trading well, without being slowed down by complex local tax and compliance issues.

Market Context — Brazil’s Prop Trading Boom

Prop trading in Brazil has gained momentum alongside the rapid growth of the local market. The B3 exchange went from just 700,000 retail accounts in 2018 to over 3.9 million today. This surge shows how many Brazilians are entering trading for the first time, creating demand for funded accounts and prop firm opportunities.

B3’s DI Futures contract is now the most traded interest rate contract in the world, and mini-dollar and mini-Bovespa futures are popular among retail and prop traders alike. Global firms see this activity and rank Brazil as the third most attractive prop trading market worldwide, behind only India and China.

At MasterFunders, Brazilian traders can go beyond local contracts. With access to global forex, indices, metals, and crypto, plus funding programs designed for scalability, prop traders in Brazil can bridge local market experience with international opportunities.

Final Takeaway

Prop firms in Brazil are giving traders a direct path into global forex, indices, metals, and crypto markets without needing massive personal capital. With fair profit splits, instant funding options, and fast payouts, funded trading is quickly becoming the model of choice for Brazil’s new wave of traders.

At MasterFunders, Brazilian traders get access to funded accounts, clear rules, and payouts in as little as 7 days. You can start small and scale your account up to $1M+. Our goal is simple: give you real capital to trade and a fast way to collect your profits.

👉 Ready to trade with funded capital? Join MasterFunders today and unlock your prop trading career in Brazil.

FAQs

Can Brazilians join international prop firms?

Yes. Brazilian traders can join global prop firms like MasterFunders. Accounts are opened online, and payouts are processed internationally.

Do prop firms in Brazil require licenses?

Local firms fall under CVM oversight, but most international prop firms operate offshore. This makes access easier for Brazilian traders.

Is prop trading taxable in Brazil?

Yes. Trading income is generally subject to 15%–22.5% tax, depending on residency and the asset type. Offshore payouts may be simpler but still need to be declared.

What is the difference between trading with a local broker vs a global prop firm?

A local broker requires you to risk your own money. A global prop firm gives you access to firm capital, enforces clear risk rules, and pays you a profit split.