Trading in Indonesia is growing fast. Millions of people are opening accounts on local brokers, trading forex, stocks, and even crypto. But small deposits limit how much profit you can make. That is where prop firms come in.

A prop firm lets you trade with company money instead of your own savings. You pass a challenge that proves you can manage risk, and then you get funded with bigger accounts. For Indonesian traders, this is the fastest way to move past small retail accounts and trade with real size.

At MasterFunders, you can start with affordable challenge fees and scale your account to $200,000. Payouts are processed in just 7 days, and profit splits can reach up to 90 percent.

Access to Bigger Trading Accounts

Most Indonesian retail traders deposit less than $1,000 into their accounts. This limits position sizes and makes it hard to grow fast. Prop firms solve that problem by giving you access to much larger capital pools.

At MasterFunders, traders in Indonesia can start with smaller funded accounts and scale up to six-figure capital allocations. With consistent results, accounts can be increased step by step, giving traders a clear path to reach over $1M in funding.

With consistent results, traders can scale past $1M in funding. The entry point is not a large deposit like with a local broker. Instead, you follow clear rules on profit targets, daily drawdowns, and max loss.

For traders in Indonesia who want to grow faster than they could with their own money, prop firms offer a practical path forward.

Support Multiple Trading Strategies

One reason traders in Indonesia are turning to prop firms is the freedom to use different strategies. Some prefer scalping on short time frames. Others like swing trading that holds positions for days. Many use algorithmic trading or Expert Advisors (EAs) on MT4 and MT5. Even crypto trading is supported on most platforms.

This flexibility matters because not every trader succeeds the same way. Reports show that about 80 percent of traders fail prop firm challenges worldwide, but Indonesia and South East Asia are among the regions with the highest participation. The trading culture here is strong, and prop firms give those motivated traders more chances to succeed.

At MasterFunders, Indonesian traders can use their own style as long as they follow simple risk management rules. That balance of discipline and flexibility is what keeps you in the game longer.

Multi-Asset Trading in Indonesia

Indonesian traders don’t just stick to one market. Popular pairs include XAU/USD (gold vs USD), EUR/USD, and GBP/USD, which are all available on MasterFunders accounts. Beyond forex, prop traders in Indonesia can also trade indices, metals, and crypto, with leverage options that make these global markets more accessible.

With MasterFunders, you can trade:

- Forex currency pairs

- Global indices

- Metals like gold and silver

- Cryptocurrencies

Indonesia also has a unique angle in trading. The country is one of the top adopters of cryptocurrency in South East Asia, and local traders are highly active in Bitcoin and altcoins. At the same time, interest in commodities and forex remains very strong.

Prop firms let you combine all of these opportunities without needing to split small deposits across many accounts. You trade bigger, in more markets, with one funded account.

Education and Mentorship

Good trading takes more than just money. It takes education and community support — especially in Indonesia, where financial literacy remains relatively low (OJK reports only 38% of Indonesians have strong financial knowledge). That’s why MasterFunders offers resources, webinars, and active communities on Discord and Telegram. For new traders, this education can be as valuable as the funding itself.

At MasterFunders, Indonesian traders get access to:

- Webinars and tutorials on strategy and risk management

- Online communities where traders share tips and stay motivated

- Guides that explain trading terms in plain language (see our Prop Trading Glossary)

For beginners, this support can be the difference between failing early and building a long career. And for advanced traders, it provides a network of peers to exchange ideas with.

Most important, every trader must learn to manage risk. Without it, even skilled traders lose accounts. That is why MasterFunders sets clear risk management rules such as daily loss limits to keep you disciplined.

Seamless Onboarding for Indonesian Traders

Getting started with a prop firm should not be complicated. At MasterFunders, traders in Indonesia can choose between different paths:

1-Step Challenge

- Profit Target: 10%

- Daily Drawdown: 4%

- Max Loss: 5%

2-Step Challenge

- Phase 1 Profit Target: 10%

- Phase 2 Profit Target: 5%

- Daily Drawdown: 5%

Pass the challenge and you’ll receive a funded account with payouts in just 7 days. Strong traders can scale their accounts up to $1M+.

Instant Funding is also available. This means you can start trading from day one with up to $100,000 in firm capital. Earn just 1% profit and request your payout immediately.

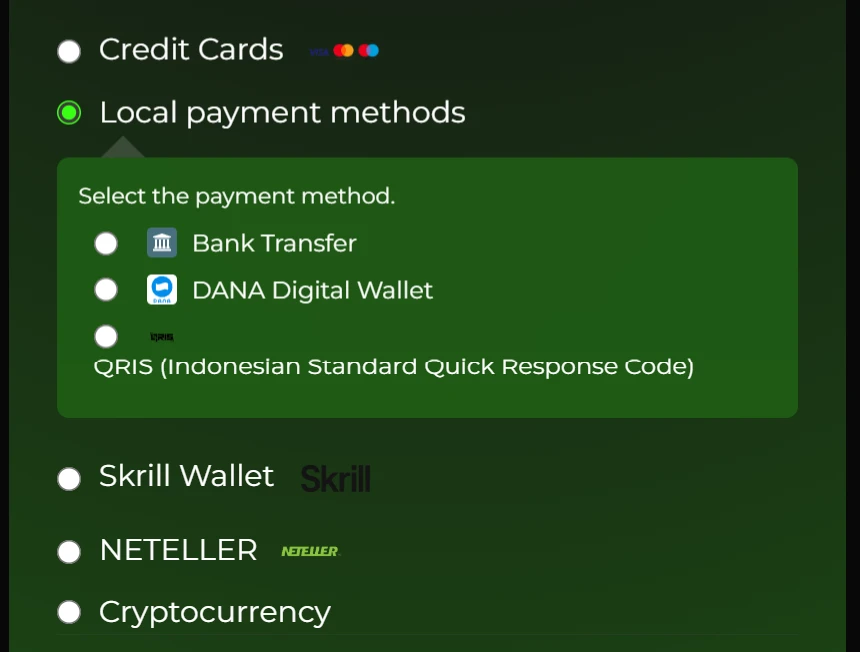

To make the process easier for Indonesian traders, MasterFunders supports local payment methods:

- Bank Transfer (local banks)

- DANA Digital Wallet

- QRIS (Indonesian Standard Quick Response Code)

Plus, you can also use Skrill, Neteller, credit cards, or cryptocurrency. This way, you can fund and withdraw with the methods you already use, without worrying about expensive international transfers.

Regulation and Taxes for Prop Traders in Indonesia

In Indonesia, forex trading is legal and regulated by BAPPEBTI, the national futures regulator. Local brokers must hold a license, but most prop firms operate offshore, making it possible for Indonesian traders to access global funding programs. This distinction is key, since domestic brokers face tight restrictions, while prop firms offer more flexible access to capital.

When it comes to taxes, profits from trading are considered taxable income. The rate usually depends on residency and the type of asset. For forex and derivatives, tax can be around 10% to 20%, while stock trading has its own rules. Since many prop firms pay traders through international payouts, you should still declare earnings as income to stay compliant.

The advantage of joining a global prop firm is clear. You avoid the high deposit requirements of local brokers while still keeping access to international markets.

Indonesia’s Trading Boom

Prop trading in Indonesia has gained momentum alongside the rapid growth of local markets. The Jakarta Futures Exchange (JFX) reported 14.7 million lots traded in 2023, with forex volumes alone up 0.5% year over year. Most Indonesian traders are millennials, beginners, and male, often starting with small retail accounts before exploring prop firm challenges. This younger demographic is fueling demand for funded accounts and global access.

- Indonesia ranks in the top 10 countries worldwide for cryptocurrency adoption.

- Local brokers report steady growth in forex trading volume year after year.

- Younger traders, especially those under 35, are driving demand for prop firm opportunities.

Global prop firms see Indonesia as a high-growth market, alongside India and Brazil. This makes it one of the top three regions in emerging-market prop trading.

At MasterFunders, Indonesian traders can bridge both worlds: trade global markets like forex, indices, metals, and crypto while also using local payment methods (Bank Transfer, DANA, QRIS) for easy access.

Final Takeaway

Prop firms in Indonesia are giving traders a faster way to move past small retail accounts and trade with real size. With access to funded capital, flexible strategies, and global markets, Indonesian traders now have more opportunities than ever before.

At MasterFunders, you can start with affordable challenge fees, scale to $200K accounts, and even unlock instant funding up to $100K. Payouts are processed in as little as 7 days, and local payment support makes it simple for Indonesian traders to get started.

👉 Ready to grow your trading career? Join MasterFunders today and start trading with funded capital in Indonesia.

FAQs About Prop Firms in Indonesia

Can Indonesians join international prop firms?

Yes. Indonesian traders can open accounts with international prop firms like MasterFunders. The process is online, and payouts are sent through supported payment methods, including local options.

Do prop firms in Indonesia need licenses?

Local brokers must be registered with BAPPEBTI. Prop firms usually operate offshore, which lets them accept Indonesian traders without going through the same licensing process.

Is prop trading taxable in Indonesia?

Yes. Trading income is taxable and should be declared as income. Rates range from about 10% to 20% depending on the asset and residency.

How do I pay for a prop trading challenge in Indonesia?

MasterFunders supports Bank Transfer, DANA, QRIS, Skrill, Neteller, and crypto, making it easy for Indonesian traders to pay for challenges and receive payouts.

Is prop trading halal in Indonesia?

Yes. Forex trading is considered halal under DSN-MUI rules if done via spot contracts, without riba (interest), and without gambling-like systems. Since prop firms use real market execution with clear risk rules, many Indonesian traders view prop trading as compliant when following these conditions.

How do I avoid scams when trading in Indonesia?

Indonesia has faced scams from unlicensed brokers and “robot trading” schemes. To stay safe, join trusted international prop firms like MasterFunders that have transparent rules, simple profit splits, and fast payouts instead of promises that sound too good to be true.