Prop firms in Germany give traders a chance to trade with company money instead of risking personal savings. By following clear risk rules, you can scale up, keep most of the profits, and get payouts quickly. For German traders, this means combining the country’s strong financial markets with modern funded account opportunities.

Why Germany Is A Prime Market For Prop Trading

Germany is one of Europe’s biggest hubs for investing and trading. In 2023, over 12.3 million Germans invested in shares, funds, or ETFs. That’s nearly 18% of the population, according to Deutsches Aktieninstitut (DAI). This shows a strong base of individuals already engaged with markets.

At the same time, Germany has some of the strictest investor safeguards in Europe. Under BaFin and ESMA regulations, retail traders face leverage caps, margin protections, and negative balance rules. While these rules sometimes limit how much risk a trader can take with their own account, they create a safer environment for beginners and experienced traders alike.

For those looking to go beyond a personal brokerage account, joining a funded account program is the next logical step. Learn more about how this model works in our guide: What Is a Prop Firm?.

How Prop Firms Work In Germany

A prop firm gives you access to the firm’s capital, and in return, you agree to trade under simple rules. These rules are designed to manage risk. For example, hitting a profit target while respecting daily loss limits and maximum drawdown. If you stay within the limits, you keep a profit split, often as high as 80–90%.

Most firms in Germany (and globally) offer two main paths:

- Challenges – where you prove your skills by reaching a profit target.

- Instant funding – where you start trading immediately with firm capital.

This model is different from trading with a broker, since you don’t risk your own money. Instead, the firm takes the downside risk and shares profits with you. To understand the exact conditions, check out Prop Firm Rules and how a Prop Trading Challenge typically works.

Platforms German Traders Actually Use

Prop firms in Germany don’t use the same institutional-grade platforms that banks or hedge funds do. Instead, they rely on retail-friendly platforms like MT5 or cTrader, paired with firm-side risk plugins and dashboards. These tools allow the firm to enforce drawdown rules, daily loss limits, and profit splits while keeping things accessible for traders.

Why not institutional systems? Full EMS/OMS suites like Bloomberg EMSX or FlexTrade are built for banks, carry six-figure license costs, and are loaded with compliance features that prop firms don’t need. Funded accounts are better suited to flexible, retail-grade systems.

For a full breakdown of how these platforms differ, see our guide: Institutional vs Prop Firm Trading Platforms.

Supported Strategies

German prop firms typically allow traders to choose from a range of styles. Whether it’s scalping, swing trading, or algorithmic strategies with Expert Advisors (EAs). Automated trading and news-based trading are sometimes restricted, depending on the firm’s rules.

The key isn’t the strategy itself, but how well you respect risk management. Even profitable traders can lose their funded account if they ignore rules like daily drawdowns. That’s why discipline is just as important as strategy.

If you’re new to this, check out our resources on Risk Management Rules and the Prop Trading Glossary to understand the key terms and expectations.

Markets German Traders Care About

One big reason prop trading is growing in Germany is the access to both global and local markets. On the global side, traders can work with forex, indices, metals, and crypto. On the local side, prop firms often connect traders to Eurex-listed products, including:

- DAX futures – tracking Germany’s flagship equity index

- EURO STOXX 50 futures – covering the Eurozone’s top companies

- Euro-Bund futures – a fixed-income benchmark closely tied to German government debt

According to Deutsche Börse Group and the Deutsche Finanzagentur, these contracts are some of the most heavily traded in Europe, making them essential for active traders in Germany.

Having access to multiple assets lets traders diversify, test different strategies, and adapt to changing conditions. For a comparison of trading styles across markets, see Day Trading vs Swing vs Position Trading

Regulation In Germany, Explained

BaFin applies EU rules that cap CFD leverage and protect retail clients.

Germany follows the EU’s CFD product intervention. ESMA set leverage caps for retail clients, negative balance protection, a margin close-out rule, and risk warnings. BaFin implemented these measures in Germany and continues to supervise CFD marketing and sales.

What this means for funded traders using retail platforms in Germany: if your trading involves CFDs with an EU-licensed broker, the ESMA caps and protections apply. Many prop firms operate offshore or use simulated environments, so always check how the firm structures execution and which rules apply to your account.

Before you join any firm, read the terms and order-execution details. If you need a refresher on how prop platforms differ from bank systems.

Taxes On Trading Profits (Abgeltungsteuer)

Capital gains are usually taxed at 25 percent plus solidarity surcharge, and church tax if applicable.

Germany’s flat withholding on investment income is 25 percent, plus a 5.5 percent solidarity surcharge on the tax. The effective rate is about 26.375 percent before church tax. Keep payout records and speak with a local tax advisor about your situation, especially if your prop firm is offshore.

For mindset and compliance basics while you build discipline, start here: Is Day Trading Gambling?.

Payment Methods German Traders Expect

Local rails reduce friction and improve conversions.

SEPA and SEPA Instant. Euro transfers are standard. The SEPA Instant scheme clears payments in under ten seconds, and new EU rules are accelerating instant payments across the bloc. This is the fastest, lowest-friction path for most euro payouts.

Sofort by Klarna and the giropay changeover. Sofort remains a common instant online method. Meanwhile, giropay is being wound down as the market consolidates toward new European initiatives, so expect merchants to update checkout options.

PayPal and cards. PayPal is still widely used in German e-commerce, and card acceptance continues to grow alongside account-to-account options. If you prefer a wallet approach for payouts, check availability with your firm.

If you need a quick primer on how payout speed and rails fit into trading operations, revisit our rule set here: Prop Firm Rules.

How MasterFunders supports German traders

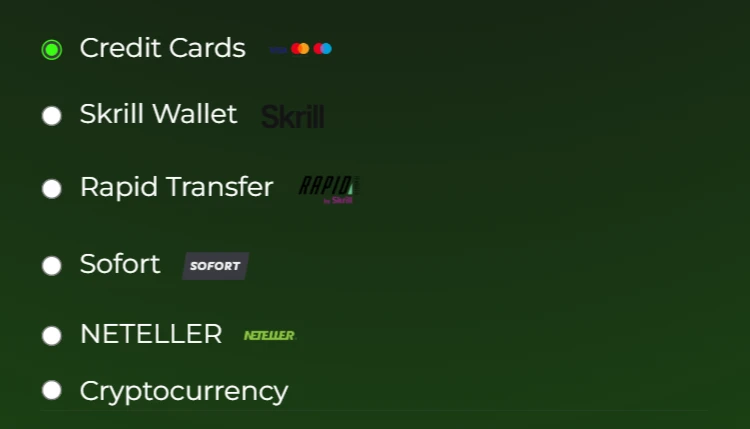

We keep funding and payouts simple for traders in Germany:

- Credit and debit cards for quick deposits.

- Sofort for instant bank-backed payments.

- Rapid Transfer by Skrill for fast bank transfers without manual IBAN entry.

- Skrill Wallet and NETELLER for wallet funding and withdrawals.

- Cryptocurrency options, where available and compliant.

- Fast verification and payouts as soon as rules allow, with clear fees shown before you confirm.

Pick the rail that fits your workflow, then focus on trading.

Onboarding Paths With MasterFunders

Pick the path that fits your style.

You choose how to start.

- 1-Step and 2-Step challenges. Clear profit targets, daily loss limits, and max drawdown so you know exactly what to hit.

- Instant funding. Start trading on day one with firm capital. No evaluation phase.

- Fast payouts and scaling. Meet the rules and request payouts quickly. Keep performing and scale to larger accounts over time.

The idea is simple. Prove you can manage risk, then grow with more capital and faster withdrawals.

Germany-Specific Pros And Watch-Outs

Benefits and limits are clear if you plan right.

Pros for German traders

- Deep markets. Access global FX, indices, metals, crypto, plus Europe’s liquid derivatives.

- Strong investor protections. EU rules from ESMA and local supervision by BaFin create clear guardrails for retail trading.

- Reliable euro payments. SEPA and instant options make deposits and payouts straightforward.

Watch-outs

- Leverage caps on retail CFDs. ESMA limits apply when you trade with EU-licensed brokers, so know your effective leverage.

- Strict marketing and conduct rules. BaFin polices promotions and disclosures in Germany.

- Taxes. Capital gains are generally taxed under the Abgeltungsteuer system. Keep payout records and talk to a tax advisor.

Plan for these points in advance and the funded route becomes a lot smoother.

Final Takeaway

Germany is a great base for funded trading if you respect rules, taxes, and risk. The market is deep, payments are reliable in euros, and guardrails from BaFin and ESMA help retail traders avoid blow-ups. Funded accounts add what most traders need, capital and structure, so you can focus on execution.

How MasterFunders helps German traders:

- Pick your start: 1-Step, 2-Step, or instant funding to trade from day one.

- Clear rules with daily loss and max drawdown that are easy to follow.

- Fast payouts once you meet the rules, with scaling for consistent performance.

- Local-friendly payments including cards, Sofort, Rapid Transfer by Skrill, Skrill Wallet, NETELLER, and crypto, with euro rails for withdrawals.

- Retail platforms you already know, plus firm-side risk controls.

- Simple onboarding and support that keeps you trading, not chasing paperwork.

Ready to trade with firm capital? Apply for a funded account with MasterFunders and start building your track record today.

FAQs

Is prop trading legal in Germany?

Yes. Trading itself is legal in Germany. When CFDs are offered to retail clients, EU rules from ESMA apply and BaFin supervises marketing, leverage limits, and protections. Prop firms are not the same as brokers, so always read the firm’s terms and execution setup.

Do I need a BaFin license to join a non-German prop firm?

No. Individual traders do not need a BaFin license to join a global prop firm. The firm must comply with any local marketing or brokerage rules where it operates. If your trades route through an EU-licensed broker, ESMA and BaFin protections apply.

How are prop firm payouts taxed under Abgeltungsteuer?

Germany generally taxes investment income at 25% plus a 5.5% solidarity surcharge on that tax, with church tax if applicable. Keep clean records of your payouts and fees, then confirm treatment with your tax advisor. See guidance from the Finanzamt in Baden-Württemberg: https://finanzamt-bw.fv-bwl.de.

Which markets are popular with German prop traders, and why?

Eurex contracts such as DAX futures, EURO STOXX 50, and Euro-Bund are liquid and cost-efficient, and they pair well with global FX, indices, metals, and crypto for diversification. See Deutsche Börse Group for derivatives info and the Deutsche Finanzagentur for Bund references.