What is a Prop Firm Challenge?

A prop firm challenge is the evaluation stage where traders prove they can trade profitably under real conditions without risking their own money. Each firm sets its own rules, but the goal is always the same: reach a profit target while respecting limits on losses. Once you succeed, you unlock a funded account and gain access to capital you would not have on your own.

At MasterFunders, traders can choose between three types of challenges. The Core Challenge offers balanced rules and realistic profit targets, while the Lite Challenge has more flexible conditions with lower targets and no daily loss restriction. For those who prefer fast-paced trading, the 24-Hour Speed Challenge allows you to prove your skills in just a single day with high leverage.

Unlike traditional brokerage accounts where the focus is simply on execution, a prop challenge is designed to assess the trader as a whole. It measures your strategy, discipline, and risk management. If you want to dive deeper into the specifics, our detailed guide on what a prop trading challenge is breaks down the rules, goals, and benefits in full.

Why Prop Firm Challenges Matter

Prop firm challenges exist for more than just evaluation. They simulate the pressures of real trading while protecting both the firm’s capital and the trader from unnecessary risk. Because you are trading with firm-provided capital, the rules ensure you develop the skills needed to thrive long term.

Many new traders focus only on making money, but the real test is consistency. That is why challenges include rules on daily losses, maximum drawdowns, and minimum trade requirements. By following these guidelines, traders learn discipline while building confidence in their strategies. Our breakdown of prop firm rules explains how these conditions work and why they are crucial for success.

For those considering prop trading as a career path, challenges are also a way to practice professionalism. They prepare you for trading environments where discipline, patience, and structured decision-making matter more than chasing fast profits. This is why passing a challenge often feels like an achievement equal to landing your first funded account.

Step 1: Build a Trading Strategy that Fits the Challenge Rules

The first key to passing a prop firm challenge is having a strategy that aligns with the rules. Many traders fail because they bring a strategy that works in personal accounts but does not adapt well to strict drawdown limits or profit targets.

Before you start, decide whether your style is better suited for short-term setups or longer swings. If you are aiming for fast results, an intraday approach may work well for the 24-Hour Speed Challenge, where you need to hit a 10 percent profit target within one day. On the other hand, the Core and Lite Challenges allow more flexibility, making them ideal for swing or position traders who prefer holding trades for longer periods.

Backtesting is critical here. By testing your strategy on years of past data, you learn what to expect in terms of win rate, drawdowns, and average returns. This not only helps you plan but also prevents emotional decisions when markets move against you. If you are still refining your approach, you might find our comparison of day trading, swing trading, and position trading useful for deciding which method best fits the challenge format.

The bottom line is simple: the right strategy is not the one that makes the most money in the shortest time. It is the one that respects the rules of the challenge and produces steady, repeatable results.

Step 2: Master Risk Management

No matter how strong your strategy is, poor risk management will end a challenge faster than anything else. Most prop firms, including MasterFunders, set strict rules on maximum daily loss and overall drawdown. Breaking these rules means immediate failure, even if your account is profitable overall.

A common guideline is to risk no more than 0.5 to 1 percent of your account balance per trade. This might feel conservative, but it creates a cushion against inevitable losing streaks. Traders who over-leverage often blow up their accounts not because their strategy is bad, but because they fail to control risk.

Another overlooked aspect is journaling. Recording your trades, entry reasons, and emotions helps you identify patterns that may be hurting your results. By reviewing these notes, you can refine your strategy while ensuring you stay within limits.

At MasterFunders, the rules are designed to encourage this type of discipline. Understanding the details of risk management in prop trading is essential before starting your challenge. By internalizing these principles, you give yourself the best chance to not only pass the evaluation but also thrive once you have a funded account.

Step 3: Strengthen Your Trading Psychology

Passing a prop firm challenge is not only about numbers on a chart. It is just as much a psychological test as it is a technical one. Many traders fail not because their strategy is weak, but because their mindset cracks under pressure.

One of the most common pitfalls is overconfidence. After a string of wins, traders often increase risk or take trades outside their plan, only to face a sharp drawdown. On the flip side, fear can paralyze decision-making after losses, leading to missed opportunities.

The key is emotional control. By treating the challenge like real trading and sticking to your plan, you avoid the rollercoaster of fear and greed. This is why consistency often matters more than speed. The firm is not looking for traders who double their accounts overnight. They want traders who can stay disciplined day after day.

Some traders also mistake trading for gambling. This mindset leads to reckless decisions and impulsive trades. If you are unsure about the difference, our article on whether day trading is gambling explains why successful traders treat the markets as a profession, not a lottery.

At its core, psychology in trading is about patience and discipline. If you can manage your emotions as well as your trades, you will already be ahead of most traders attempting the same challenge.

Step 4: Leverage MasterFunders’ Unique Features

While every prop firm has rules, not all firms give traders the same support. This is where MasterFunders stands out. Our challenge features are designed to give traders both flexibility and second chances that most competitors do not provide.

-

Second Life: If you fail during the qualifying phase, you can continue in the second step without restarting from scratch.

-

Reset Feature: If you are within 25 percent of your maximum drawdown in your first challenge, you can reset your account balance and start fresh.

-

Scaling Plan: Traders who perform consistently can increase their account balance by 25 percent every three months, up to double the original size.

-

Bi-weekly payouts: Instead of waiting a full month or longer, you can withdraw profits every 14 days once funded.

-

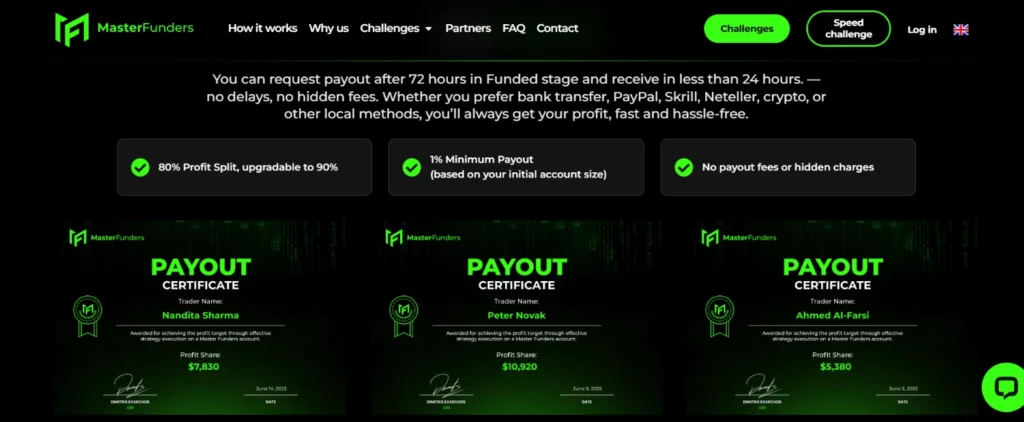

Higher profit split: MasterFunders offers up to 90 percent profit sharing, compared to the industry standard of 80 percent.

These benefits make challenges not only more achievable but also more rewarding once you pass. To see how these rules work in practice, explore our breakdown of prop firm rules.

By taking advantage of these features, you reduce unnecessary pressure and increase your chances of success. Passing the challenge is about discipline, but choosing a supportive prop firm like MasterFunders makes the path far smoother.

Step 5: Learn From Common Mistakes

Even skilled traders stumble in prop firm challenges because they repeat avoidable errors. Recognizing these pitfalls early can save both time and money.

One of the biggest mistakes is overtrading. Traders often chase setups during news events or low-liquidity sessions, which leads to unnecessary losses. Staying selective is more effective than forcing trades just to stay active.

Another common error is ignoring the rules. Many firms set conditions like minimum trade days, maximum daily loss, or unique trade requirements. Breaking any of these can disqualify you instantly, regardless of profitability. At MasterFunders, the rules are transparent and trader-friendly, but they still require strict attention.

Some traders also treat challenges like a lottery ticket. They over-leverage, hoping for a quick win, only to blow up their accounts. This gambling mindset is especially risky when trading volatile assets like crypto. If you want to avoid these traps, our guide on common mistakes in day trading crypto offers lessons that apply to all markets.

The most successful traders approach challenges as if they are managing client money. They prioritize preservation over reckless risk, understanding that survival is the real victory.

How MasterFunders Challenges Compare to Competitors

Not all prop firms design their challenges the same way. Some firms make the targets unrealistic or impose rules that restrict trading styles. This creates unnecessary pressure and reduces the chances of success.

MasterFunders takes a different approach. Our challenges start from as little as $5 and scale up to funded accounts of $200,000. Unlike many firms, there are no minimum or maximum trading days, so you are free to trade at your own pace.

We also provide unique benefits that competitors rarely match:

-

Bi-weekly payouts instead of monthly waiting periods

-

Second Life and Reset options for added flexibility

-

Refundable fees once you complete the evaluation

-

Educational resources to help traders improve at every stage

If you want a clear picture of how this compares to other setups, read our article on prop firms vs brokers. It explains why challenges are structured differently and how choosing the right prop firm can directly impact your long-term trading career.

When stacked against competitors, MasterFunders offers not only fairer conditions but also tools that support growth beyond the challenge stage. This makes it a stronger option for traders serious about building consistency.

Final Thoughts: Treat Challenges Like Real Trading

Passing a prop firm challenge is not about luck or quick wins. It is about proving that you can trade with discipline, manage risk effectively, and keep your emotions under control. The traders who succeed are not always the most aggressive but the ones who treat the evaluation as if they were already managing a large, funded account.

At MasterFunders, we make this journey fair and achievable. With transparent rules, flexible challenge options, and unique features like Second Life, Reset, and Scaling Plans, traders have more than just a chance to prove themselves. They have the tools to build long-term success.

Remember the keys to passing any challenge:

-

Build a strategy that fits the rules

-

Master risk management

-

Stay consistent and disciplined

-

Control your psychology

-

Learn from common mistakes

If you can follow these principles, you will not only pass the challenge but also be prepared to thrive with a funded account.

Start your journey today and take on a challenge designed to support your growth. Explore MasterFunders challenges now and take the first step toward trading with up to $200,000 in funded capital.

More Resources for Traders

If you are preparing for a prop firm challenge, expanding your knowledge will make you a stronger and more disciplined trader. Here are some resources from MasterFunders that can guide you further:

-

What is a Prop Firm? — Understand how prop firms operate and how they differ from brokers.

-

Prop Firm Glossary — A complete glossary of prop trading terms every trader should know.

-

Risk Management Rules for Prop Trading — Learn the essential rules that keep your capital safe.

-

Day Trading vs Swing Trading vs Position Trading — Find the trading style that best fits your personality and goals.

-

Is Day Trading Gambling? — Explore the psychology of trading and why mindset matters.

-

Common Mistakes in Day Trading Crypto — Avoid the errors that cost traders money in volatile markets.

-

Prop Firm vs Broker — Compare prop firms to traditional brokers and see which is right for you.

By exploring these guides, you can build a deeper understanding of trading strategies, rules, and market psychology. Each resource complements what you learned in this article and helps you prepare for success with MasterFunders.