Displacement in forex is a sudden, strong price movement often leaving fair value gaps. It signals institutional activity and helps traders identify momentum, structure breaks, and potential entries when combined with ICT strategies.

What is displacement in forex trading?

Displacement in forex is a sharp, directional price move that breaks structure and leaves gaps, showing institutional order flow. Traders use it to confirm bias, validate zones, and align with smart money activity.

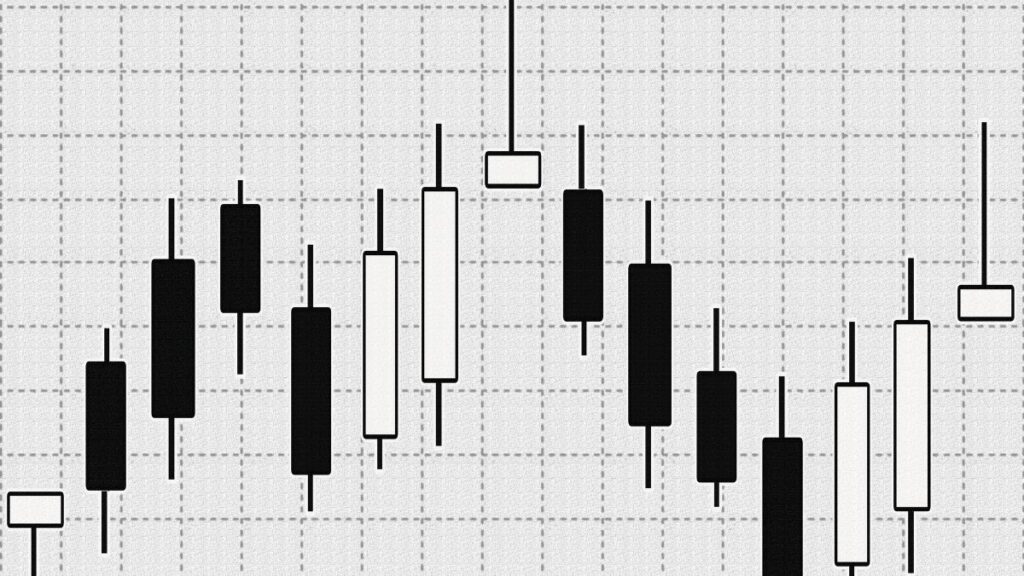

Displacement occurs when large institutions, such as banks or hedge funds, execute high-volume trades. These moves show up as consecutive strong candlesticks in one direction with minimal wicks, often creating Fair Value Gaps (FVGs). An FVG signals that price skipped levels, leaving inefficiency that markets often revisit.

In practice, displacement provides retail traders with a proxy for institutional behavior. Since institutions dominate turnover—around 75% of daily forex volume according to the Bank for International Settlements in 2022—it is critical to spot when their activity drives price (BIS, 2022). By identifying displacement, traders can anticipate liquidity sweeps, bias shifts, and trend continuations.

How do you identify displacement on a chart?

You can identify displacement by spotting consecutive large candlesticks, fair value gaps, and breaks in structure during active sessions like London and New York. It requires both pattern recognition and context.

Steps to identify displacement:

- Check session: Look for moves in London or New York kill zones, when institutional activity peaks.

- Spot candlestick sequence: Find three or more strong candles with large bodies and small wicks moving in one direction.

- Confirm Fair Value Gaps: Look for gaps between candles where price didn’t fully trade, marking imbalance.

- Assess structure: Ensure the move breaks a recent high or low, confirming momentum.

- Volume or volatility check: Cross-reference with ATR expansion or a volume spike to validate strength.

On higher timeframes, displacement can appear as just one or two large candles, while on lower timeframes, it may involve several. A reliable displacement almost always leaves a structural footprint, either a break of structure (BOS) or market structure shift (MSS).

What are bullish and bearish displacement moves?

Bullish displacement shows institutional buying through consecutive strong upward candles with FVGs. Bearish displacement shows institutional selling through consecutive downward candles with FVGs and breaks to the downside.

| Type | Characteristics | Institutional Signal | Example Pairs |

| Bullish | 3+ strong upward candles, small wicks, FVGs left | Heavy buy-side flow pushing price up | EUR/USD, GBP/USD |

| Bearish | 3+ strong downward candles, small wicks, FVGs left | Heavy sell-side flow driving price lower | USD/JPY, AUD/USD |

Bullish displacement often follows liquidity sweeps at lows before price surges higher. Bearish displacement often follows sweeps at highs before a sharp decline. Both are more reliable when they align with session timing and broader market structure.

How do traders use displacement in ICT strategy?

Traders use displacement in ICT (Inner Circle Trader) strategy to confirm supply and demand zones, validate entries, and align with institutional order flow. It is most powerful when paired with other Smart Money Concepts.

Displacement serves as confirmation, not a standalone entry trigger. For example, if a trader marks a demand zone, a strong bullish displacement out of that zone suggests institutional buying. This increases confidence that the zone is valid. Similarly, bearish displacement from a supply zone signals smart money selling.

ICT practitioners also use displacement to confirm market structure bias. When displacement breaks structure in one direction, traders shift bias accordingly. For instance, a strong bullish displacement breaking a previous high suggests a bullish continuation. If displacement causes a change of character (CHOCH) or market structure shift (MSS), it signals a possible trend reversal.

In practice, displacement is paired with other ICT tools:

- Fair Value Gaps (FVGs): Entries often align with retracements into the FVG.

- Order Blocks: Displacement validates whether an order block is active.

- Kill Zones: Moves during London or New York sessions are stronger and more reliable.

What are the rules for trading displacement safely?

Safe displacement trading requires confirmation, invalidation rules, and strict risk management. Traders must ensure moves are genuine institutional activity, not false spikes or news-driven volatility.

Checklist for displacement trading:

| Rule Category | Valid Signal | Invalidation Condition |

| Candlestick | 3+ strong bodies, small wicks | Wick-heavy candles, indecision bars |

| Structure | Breaks prior high/low | No BOS or MSS |

| Fair Value Gaps | Clear gap between candles | Gap immediately filled |

| Session Filter | London or New York kill zones | Moves in Asian session |

| Volatility Check | ATR expansion or volume spike | Low-volume drift move |

By applying these rules, traders reduce false positives. Importantly, displacement should always be combined with a clear entry model. Without context, large candles can mislead. Traders should also avoid entering right before high-impact news releases, as those often create deceptive moves.

How does displacement help in prop firm challenges?

Displacement helps prop firm traders by providing high-probability setups that align with firm rules for profit targets and drawdown limits. It supports disciplined execution, especially under structured evaluations.

Most prop firm challenges, including MasterFunders, require traders to achieve profit targets (5 to 10 percent) while avoiding maximum daily losses (5 percent) and maximum overall drawdown (10 percent). Displacement setups can help reach these objectives efficiently.

For example:

- Profit Target Alignment: Strong displacement moves provide entries with a high risk-to-reward ratio, allowing traders to capture 1:2 or 1:3 setups that align with an 8 percent target.

- Drawdown Control: By waiting for displacement confirmation, traders avoid impulsive trades that could trigger daily loss limits.

- Scaling Plan Fit: Consistently trading displacement setups supports the scaling plan, where account size can increase 25 percent every three months with discipline.

By applying displacement strategically, traders improve their chance of passing challenges and maintaining funded status.

What are the benefits and limitations of trading displacement?

The benefit of displacement trading is clarity on institutional flow and high-probability setups. The limitation is that not every large move reflects smart money, making false signals a real risk.

Benefits:

- Confirms institutional activity through strong, clear moves.

- Validates supply and demand zones, order blocks, and fair value gaps.

- Offers higher risk-to-reward setups when aligned with market structure.

Limitations:

- False signals may arise from news events or liquidity sweeps.

- Requires context with other tools; displacement alone is insufficient.

- Volatility can lead to slippage, widening spreads, or unfavorable fills.

For traders in prop firm challenges, these limitations reinforce the need to combine displacement with risk controls. Using displacement as confirmation rather than a primary entry helps balance opportunity and discipline.

Extra tips for trading displacement effectively

Trading displacement is safer when paired with structure, session filters, and liquidity awareness. Following a few rules improves consistency.

Practical tips:

- Wait for market structure breaks: Combine displacement with a BOS or MSS for stronger confirmation.

- Combine with Fair Value Gaps: Look for retracements into FVGs after displacement for entries.

- Trade major pairs: EUR/USD, GBP/USD, and USD/JPY are more reliable for displacement setups.

- Stick to kill zones: Focus on London and New York sessions when institutional activity peaks.

- Manage risk tightly: Use stop-loss orders beyond liquidity zones and aim for 1:2 or 1:3 risk-reward setups.

These practices help traders filter out noise and focus on the moves most likely to reflect institutional intent.

Frequently asked questions about displacement forex

What is displacement in forex?

Displacement is a sharp price move, often leaving Fair Value Gaps, that signals institutional trading activity and momentum.

Is displacement bullish or bearish?

It can be either. Bullish displacement reflects strong buying pressure, while bearish displacement reflects strong selling pressure.

Can displacement alone be a trading strategy?

No. Displacement works best when combined with supply and demand zones, order blocks, and market structure analysis.

Which timeframes work best for spotting displacement?

On lower timeframes, displacement appears as three or more strong candles. On higher timeframes, it can appear as just one or two.

How does displacement help in prop firm trading?

It improves discipline, confirms bias, and helps traders align with profit targets while staying under drawdown rules.

Resources on Displacement in Forex

Authoritative References

- CME Group – Was 2024 a Year of Volatility?

- BIS – Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets, 2022

MasterFunders Guides