Tired of endless evaluations? No evaluation prop firms let you skip the tests and start trading real capital from day one. Instead of proving yourself through multi-step challenges, you can access a funded account instantly and focus on what matters most. Trading.

But not all no-eval prop firms are created equal. Some load traders with hidden restrictions, high fees, or unfair payout rules. That’s why it’s crucial to understand how this model works and which firm actually sets you up for long-term success.

In this guide, we’ll break down what no evaluation prop firms are, the key pros and cons, and why MasterFunders’ Instant Funding program is the safer, smarter option for traders who want to trade with real capital immediately.

What Is a No Evaluation Prop Firm?

A no evaluation prop firm (also called an instant funding prop firm) allows traders to access capital without going through a traditional evaluation or challenge process. Instead of proving your skills over weeks or months, you can start trading with firm-provided capital from day one.

Here’s how it differs from the standard model:

- Traditional evaluation firms: Traders must pass one or two challenge phases by hitting profit targets while respecting strict drawdown rules. Only after passing these phases do they unlock funded accounts.

- No evaluation firms: Traders skip the assessment entirely. With a one-time fee, they gain direct access to a funded account and can withdraw profits almost immediately.

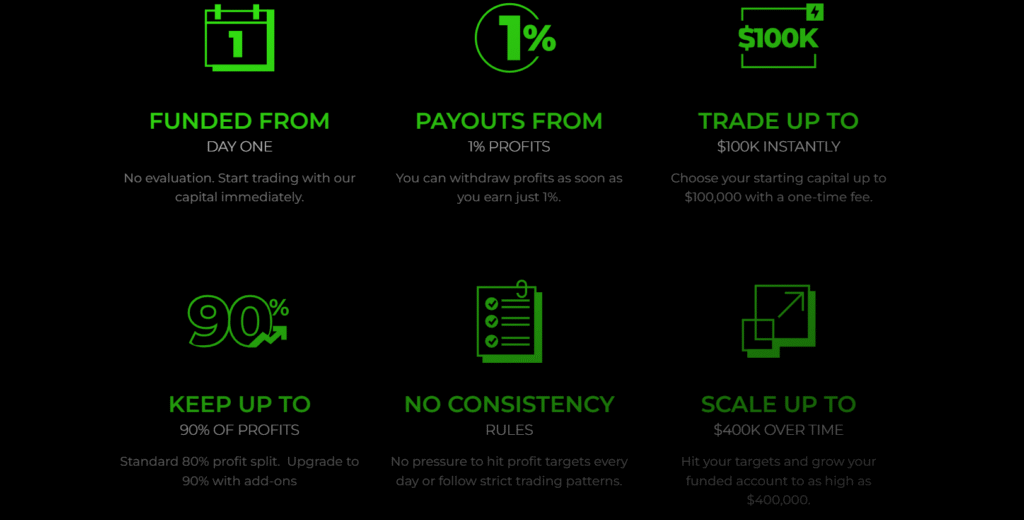

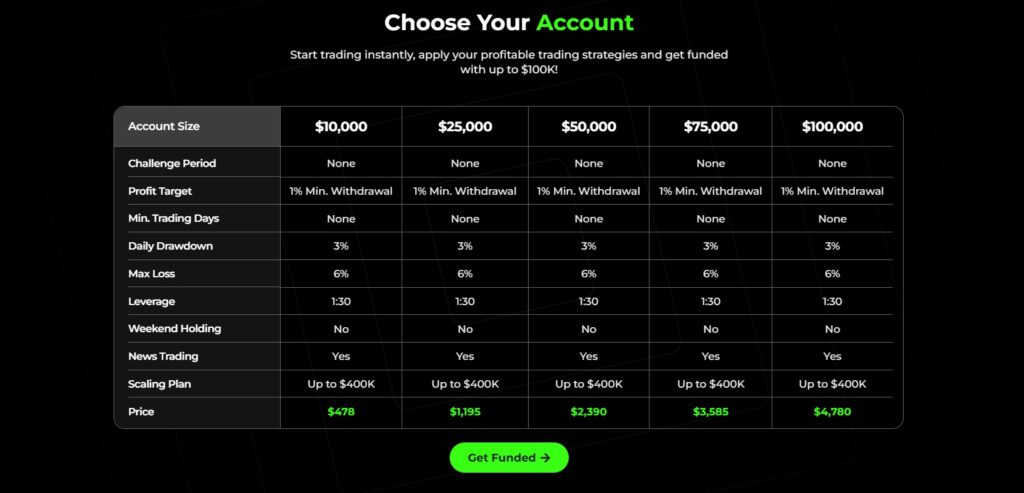

The biggest draw is immediate access to capital. With MasterFunders, you can choose account sizes from $10K up to $100K, withdraw profits as soon as you hit just 1%, and scale your account all the way to $400K over time.

For many traders, this means skipping the stress of tests and getting straight to real opportunities.

Related: Learn about the exact prop firm rules and risk management strategies that keep your trading account protected while giving you maximum freedom.

Pros and Cons of No Evaluation Prop Firms

Like any funding model, instant funding comes with both benefits and trade-offs. Knowing both sides helps you choose the right firm for your goals.

✅ Pros of No Evaluation Prop Firms

- Instant Access to Capital – Start trading with real capital immediately, no waiting for evaluations.

- Reduced Pressure – Without the stress of passing tests or hitting strict metrics, traders can focus on making smart trades.

- Flexibility – Many no-eval firms allow a wider range of strategies, including overnight and weekend trading.

- Fast Withdrawals – Depending on the firm, payouts can be requested much sooner than traditional evaluation accounts. With MasterFunders, you can withdraw profits after hitting just 1% growth.

⚠️ Cons of No Evaluation Prop Firms

- Higher Fees at Some Firms – Many competitors charge steep one-time payments to offset the risk of funding untested traders.

- Risk of Inexperience – Without evaluations, some traders may jump in too quickly, leading to poor results and early account breaches.

- Stricter Rules Elsewhere – Some no-eval prop firms balance their risk with restrictions (like tight drawdown rules or limited trading styles).

This is where MasterFunders stands out. Unlike many competitors, MasterFunders combines the speed of instant funding with fair rules, low fees, and industry-leading payouts of up to 90%. That means traders enjoy the benefits of direct funding without getting trapped by unfair restrictions.

Common Rules for No Evaluation Accounts

Even though no evaluation prop firms let you skip challenges, they’re not completely “rule-free.” These firms still set guidelines to protect their capital and maintain fairness among traders.

Here are the most common rules you’ll find:

1. Drawdown Limits

Every funded account will have a maximum daily and overall drawdown limit. This ensures traders manage risk and don’t blow accounts in a single trade. At MasterFunders, drawdown rules are kept clear and transparent, with no hidden traps.

👉 For a deeper dive into how risk limits work, check out MasterFunders’ full guide to prop firm risk management rules.

2. Prohibited Strategies

Most no-eval firms restrict ultra-high-risk strategies such as:

- High-frequency trading (holding positions for just a few seconds)

- Grid trading and martingale systems

- Placing orders during high-impact news events

3. Withdrawal Rules

Some instant funding prop firms delay payouts until traders hit very high targets. Others enforce long lock-in periods before allowing withdrawals.

By contrast, MasterFunders allows withdrawals starting at just 1% profit, with fast processing times so you can access your capital quickly.

4. Consistency Scores

A few firms use “inconsistency” or “trader value” scores to judge whether your profits are sustainable. If your best trading day makes up too large a percentage of total profits, your withdrawals may be delayed.

MasterFunders skips the unnecessary complexity. As long as you trade responsibly within the rules, you can scale your account and withdraw without gimmicky restrictions.

How MasterFunders Makes No Evaluation Funding Better

No evaluation prop firms can be hit or miss. Some overcharge, some over-restrict, but MasterFunders bridges the gap between speed and sustainability.

Here’s why traders choose MasterFunders’ Instant Funding Program over the competition:

- Funded from Day One – Start trading immediately without challenges or tests.

- Low Fees, High Value – One-time fees are transparent and significantly lower than many competitors, making funding accessible to more traders.

- Payouts Starting at Just 1% – No need to wait weeks or hit huge targets to withdraw your profits.

- Up to 90% Profit Split – Keep more of what you earn. Most firms cap at 80%, but MasterFunders lets you scale your profit share over time.

- Scale Up to $400K – Consistent performance means your account can grow steadily under the Scaling Plan.

- Fair Trading Conditions – No hidden restrictions. You can hold overnight trades, trade weekends, and even participate in news events.

In other words, MasterFunders delivers the freedom traders want from instant funding without the downsides that plague many no evaluation firms.

Is a No Evaluation Prop Firm Right for You?

While instant funding sounds like every trader’s dream, it’s not a one-size-fits-all solution. Here’s how to know if a no evaluation prop firm is the right fit for your trading journey:

✅ Best for:

- Experienced Traders who already have proven strategies and don’t want to waste time on evaluation tests.

- Confident Risk Managers who can trade responsibly within drawdown limits.

- Scalpers & Swing Traders who value the freedom to trade overnight, on weekends, or during news events.

⚠️ Not ideal for:

- Beginners who are still learning trading fundamentals. Evaluations can help new traders develop discipline before handling larger capital.

- Traders without a plan who may risk breaching drawdown limits quickly without structure.

If you’re new, you might first explore MasterFunders’ Core or Lite Challenges, which balance training with funding opportunities. But if you’re ready to skip the tests, the Instant Funding program lets you start trading real capital from day one.

Why Choose MasterFunders Over Other No Evaluation Firms?

With dozens of no-evaluation firms popping up, traders need to separate hype from reliability. Here’s how MasterFunders compares against competitors:

| Feature | MasterFunders | Typical No-Eval Competitors |

| Funding Start | Instant, from day one | Instant, but often with hidden restrictions |

| Profit Split | Up to 90% | Usually 70–80% |

| Withdrawals | From 1% profit, fast payouts | Often require 5–10% before first withdrawal |

| Scaling Plan | Scale up to $400K over time | Limited or no scaling |

| Trading Rules | Fair: overnight, weekend, and news trading allowed | Often prohibit news, weekends, or restrict assets |

| Fees | Transparent, lower one-time fees | High upfront fees, sometimes recurring |

| Global Reach | 100+ countries served | Limited to fewer regions |

The takeaway? MasterFunders gives traders the speed of no evaluation funding, without the hidden costs or restrictive rules that other firms use to cover their risks.

Instead of worrying about whether your prop firm will let you trade your way, you can focus on what matters: growing your account, withdrawing profits, and scaling your trading career.

Get Funded Instantly with MasterFunders

The world of no evaluation prop firms is growing fast, but not every firm puts traders first. Some load you with hidden restrictions, slow payouts, or high fees. That’s why choosing the right partner makes all the difference.

With MasterFunders’ Instant Funding Program, you get:

- Funded from day one – no tests, no delays.

- Withdraw profits starting at just 1% growth.

- Up to 90% profit split — keep more of what you earn.

- Fair, trader-friendly rules that let you trade overnight, on weekends, and during news events.

- Scaling up to $400K with consistent performance.

Whether you’re an experienced trader tired of evaluations, or a disciplined scalper ready to put your strategies into action immediately, MasterFunders is your gateway to trading with bigger capital without risking your own funds.

Ready to skip the challenges and start trading real capital today?

Explore MasterFunders’ Instant Funding Program and unlock your account now.