Trading is growing fast in India. Millions of people now use NSE and BSE to trade stocks and futures. Many also look at forex, gold, and even crypto. But small deposits limit how much profit you can make.

That’s where a prop firm in India comes in. A prop firm gives you company money to trade with. You follow simple rules, and if you make profits, you keep most of them. With MasterFunders, Indian traders can start with small challenge fees, scale to accounts as big as $200,000, and get payouts in as little as 7 days.

This guide explains how prop trading really works for Indian traders in 2025, covering legality, SEBI/RBI rules, payments like UPI and IMPS, taxes, strategies, and why MasterFunders is different.

Why India Is Different for Prop Trading

India is one of the largest retail trading markets in the world. NSE and BSE see huge daily volumes in equities and futures & options. At the same time, Indian traders show strong interest in forex, commodities, and crypto through offshore platforms.

India also has some of the best talent in math, coding, and engineering. Many Indian quants already work in top hedge funds and trading desks worldwide. But at home, very few prop firms run public “funded account” challenges.

Here’s the key point:

- Domestic prop firms in India usually exist inside banks or big institutions, and they don’t offer public challenges.

- Offshore prop firms like MasterFunders let Indian traders join online, prove their skills, and trade global markets with firm capital.

This is why prop trading in India looks different compared to places like Brazil or Indonesia.

👉 Learn the basics: What is a Prop Firm? | Prop Firm vs Broker

Is Prop Firm Trading Legal in India?

Yes, prop trading is legal in India. Banks and brokerages have used proprietary trading for years. But the challenge-based funding model, where a trader pays a small fee, passes an evaluation, and then gets funded, mostly comes from offshore firms.

Here’s how regulation works:

- SEBI regulates securities, stocks, and F&O inside India.

- RBI and FEMA oversee forex flows and cross-border payments.

- Since most prop firms are offshore, they sit in a gray area. That means Indian traders can join, but it is important to use clean payment methods and keep records for taxes.

What “gray area” means in practice:

- You don’t need a license to join a prop firm as a trader.

- But you should check if the firm is transparent about rules and payouts.

- Always use proper payment flows (like UPI, IMPS, or approved wallets).

- Keep all invoices and payout statements for your tax filings.

👉 At MasterFunders, everything is clear. Simple rules, transparent payouts, and India-friendly payment options.

How Funded Accounts Work for Indian Traders

At MasterFunders, Indian traders can choose between two main paths to funding:

1. Evaluation Challenges – Prove Your Skills

The Evaluation Path is designed for traders who want to show consistency, discipline, and risk management before trading firm capital. It is a step-by-step process:

- Step 1 – Challenge: Hit the profit target while respecting daily loss and drawdown rules.

- Step 2 – Qualifying Phase: Confirm your discipline and trading consistency.

- Step 3 – Become a MasterTrader: Trade a funded account, scale up to $400K, and keep up to 90% profits.

👉 Prefer to skip this? Check the Instant Funding program below.

Core Challenge – Balanced and rewarding

-

- Two-step evaluation (8% + 5% targets)

- 5% daily drawdown, 10% max loss

- Refundable fee once you pass

- Profit split up to 90%

Lite Challenge – Flexible with stricter risk rules

-

- Two-step evaluation (5% + 5% targets)

- 5% daily drawdown, 5% max loss

- Refundable fee once you pass

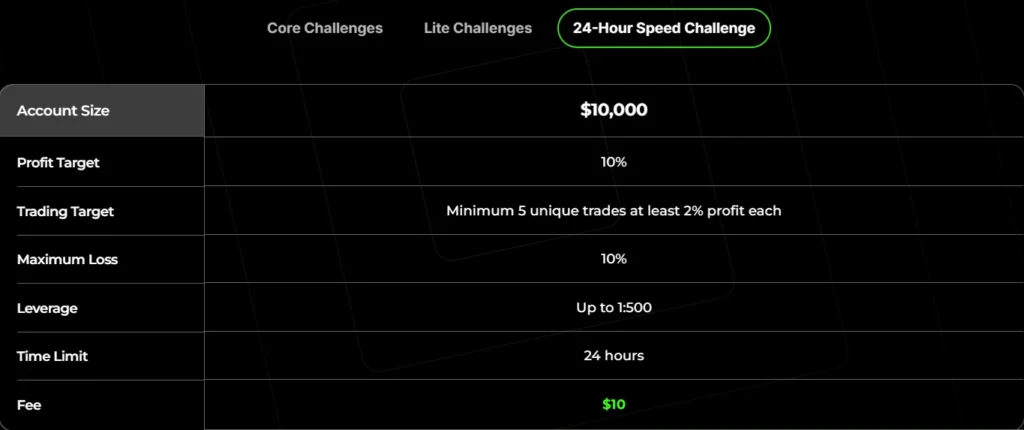

Speed Challenge – Fast track to funding

-

- One-step, 24-hour evaluation

- 10% profit target, 10% max loss

- Earn a free Core Challenge if you pass

- Profit split up to 90%

👉 Learn more: Prop Firm Rules | What Is a Prop Trading Challenge? | Risk Management Rules

2. Instant Funding – Start Trading From Day One

With Instant Funding, you skip the evaluation and start with a funded account right away.

- Account sizes: $10K to $100K

- Withdraw profits after just 1% gain

- 3% daily drawdown, 6% max loss

- Scale up to $400K over time

- Keep up to 90% profits

This is ideal for traders who want immediate access to capital without passing a challenge.

Platforms Indian Traders Actually Use

MasterFunders uses a powerful platform called Match-Trader. This is the software where you’ll trade, track your account, and manage your challenges, all in one place.

Why Match-Trader is made for prop traders like you:

- It shows your progress clearly, like your profit target, daily loss, and how close you are to passing your challenge.

- You can look at your trades using TradingView charts and regular charts that help, whether you’re new or more advanced.

- It works on your phone and in your browser like an app, no need to download anything.

- You get a dedicated dashboard where you see stats like how many trades you made, your win ratio, average profit or loss, and when you reached goals.

- It has a mini calendar and shows “Top Movers” — helpful for knowing market events or fast-moving symbols.

Match-Trader also ties directly into how MasterFunders runs its programs. When you pick a challenge, the platform knows the rules (like profit target, max loss, daily drawdown). It tracks everything in real time and lets you see how close you are to passing.

Match-Trader makes trading funded accounts smoother because everything you need, charts, account info, challenge rules, stats, is right there and easy to use.

👉 Related: Institutional vs Prop Firm Trading Platforms

Supported Strategies That Fit India’s Schedule

Every trader has a different style. At MasterFunders, Indian traders can choose the strategy that works best for them, as long as they respect the risk rules.

- Scalping: Taking quick trades during high-volume times.

- Swing trading: Holding positions for a few days.

- Algo/EAs: Using automated systems if they follow firm rules.

The good thing about trading from India is the time zone. You get strong liquidity when:

- London markets overlap: 1:30 pm to 5:30 pm IST

- New York session starts: 6:30 pm to 10:30 pm IST

This makes evenings a great time to trade without missing global moves.

At MasterFunders, you also have freedom. News trading is allowed, and you can hold positions overnight or over weekends if your plan requires it.

👉 Learn more: Prop Trading Glossary | Day vs Swing vs Position Trading

Markets Indian Traders Care About

Indian traders like to trade both local and global markets. With MasterFunders, you get access to major global assets:

- Forex majors like EUR/USD, GBP/USD, and USD/JPY

- Gold (XAU/USD), which is one of the most traded pairs by Indian traders

- Indices such as US30 (Dow Jones) and NAS100 (Nasdaq)

- Crypto majors like Bitcoin (BTC) and Ethereum (ETH)

Locally, many traders also follow Nifty and Bank Nifty through Indian brokers. While these are not traded through prop firms, they give insights that help with global market setups.

The advantage of prop trading is that you can diversify. Instead of putting all your money into one market, you can spread across forex, gold, indices, and crypto. This smooths out your results and helps build a more stable equity curve.

👉 Related: Common Mistakes Day Trading Crypto

Payments That Work in India (And What to Avoid)

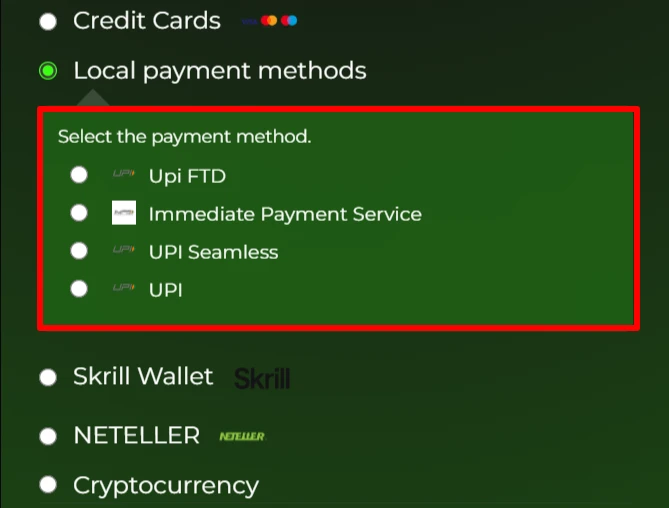

Getting money in and out of your prop firm account is one of the biggest concerns for Indian traders. MasterFunders supports India-friendly payment methods, making it easy to start and withdraw:

- UPI (FTD, Seamless, Standard)

- IMPS (Immediate Payment Service)

- Skrill and Neteller

- Crypto payments if you prefer digital options

Always keep your payment trail clean. Use your own accounts, avoid third-party transfers, and store receipts. This makes it easier for both compliance and taxes later.

What you should avoid:

- Opaque offshore wires that are hard to trace

- Unverified wallets that do not provide receipts

By keeping clean records, you protect yourself if banks or regulators ask questions.

👉 MasterFunders supports India-friendly methods like UPI and IMPS so you can start faster and withdraw safely.

Taxes 101 for Indian Prop Traders

Prop firm payouts are treated as income in India for most traders. Usually, this is reported as business or professional income.

What you should do:

- Keep copies of invoices, payout statements, and platform reports

- Track forex conversion records if you receive payments in USD or crypto

- Report foreign-sourced income if payouts come from international accounts

Taxes in India can vary depending on your structure. Some traders register a business, while others report as individuals. It is always smart to consult a chartered accountant (CA) to decide the best option for you.

Risk, Compliance, and Your Playbook

Success in prop trading is not only about profit. It is about discipline. MasterFunders sets risk guardrails to keep traders safe:

- Daily loss limits so you never blow up in one bad day

- Maximum drawdown rules that protect your account

- Tips like reducing position size after a loss to stay in control

On the compliance side, you should:

- Keep invoices and payout statements

- Use clear payment labels when sending or receiving money

- Always read the firm’s Terms and Conditions before paying

Onboarding Paths With MasterFunders (Built for India)

Indian traders can choose how they want to start:

- Evaluation Challenges

- Core Challenge, Lite Challenge, or Speed Challenge

- Prove your skills with clear targets and risk limits

- Refundable fees once you pass

- Instant Funding

- Skip the challenge and start with $10K–$100K

- Withdraw profits after just 1% gain

- Grow your account up to $400K

MasterFunders also has a Scaling Program, where your balance can grow by up to 100 percent in a year if you stay consistent.

Payouts are simple. Your first payout can be requested after 7 days, and then they become flexible.

👉 Apply now for India-friendly onboarding and start trading a funded capital today.

India-Specific Pros and Watch-Outs

Pros for Indian traders:

- One of the largest trader communities in the world

- Strong fintech rails like UPI and IMPS for fast payments

- Evening trading overlaps with both London and New York sessions

Watch-outs to remember:

- Regulation is still evolving and rules may change

- Banks may flag unusual transfers if records are unclear

- Taxes on trading income are required and should not be ignored

Final Takeaway

Prop firms give Indian traders a chance to trade bigger without risking personal capital. With MasterFunders, you can start with account sizes from $10,000 to $100,000, which is about ₹8.2 lakh to ₹82.4 lakh (assuming $1 ≈ ₹82). That is around 8 to 87 times the average Indian annual salary (₹9.45 lakh). This means with one funded account, you are trading with capital that many people would earn over nearly a decade.

The real edge is in process and discipline, not prediction. With India-friendly payments like UPI and IMPS, instant funding, fast payouts, and scaling programs, MasterFunders is a trusted global prop firm for Indian traders.

👉 Apply today and start trading with real firm capital from India.

FAQs

Is it legal for Indians to join an international prop firm?

Yes. Prop trading is legal in India. Joining an offshore prop firm like MasterFunders is allowed, but traders should keep clean records of payments and payouts.

Do I need an Indian license to join?

No, you do not need a license to join a foreign prop firm. You just need to follow the firm’s rules and keep your payment trail clear.

How are payouts taxed?

Payouts are treated as income in India, often under business or professional income. You should keep invoices, payout statements, and forex conversion records. A chartered accountant can guide you on reporting foreign income.

Which strategies fit Indian hours?

The best times are the London session (1:30–5:30 pm IST) and New York session (6:30–10:30 pm IST). Scalping and swing trading work well in these hours.

What should I check before paying?

Look for clear rules, transparent payout policies, trusted payment methods like UPI or IMPS, and realistic profit targets. Avoid firms that hide their terms.