When traders look for a prop firm with the largest drawdown, they’re usually looking for one thing: more room to trade freely.

A larger drawdown means a trader can hold trades longer, survive normal pullbacks, and recover from small mistakes without breaching the prop firm’s rules.

But “largest drawdown” can mean different things depending on how the prop firm measures it.

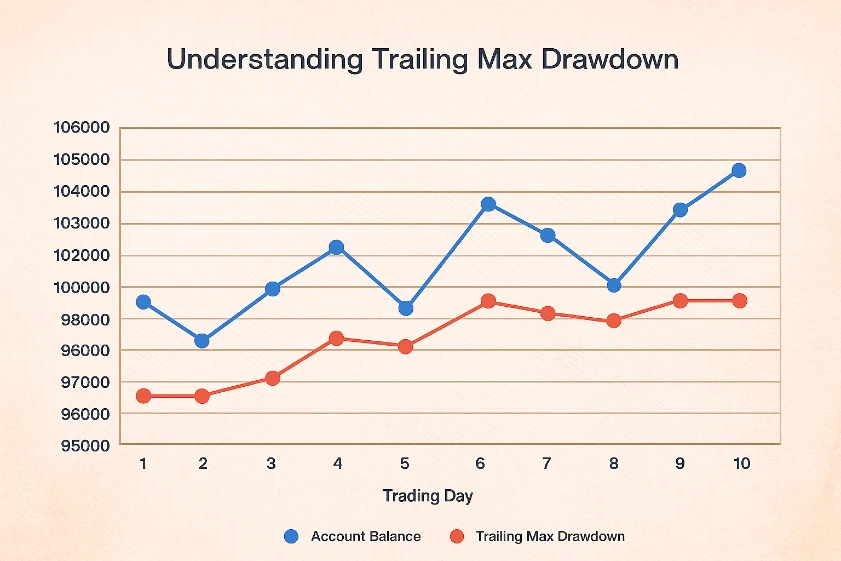

Some firms use trailing drawdown, where the limit moves up as your equity grows, while others use static drawdown, which stays fixed based on your starting balance.

A higher percentage isn’t always better if the firm uses a trailing or equity-based system that tightens as you profit.

In this guide, we’ll explain what maximum drawdown means in prop trading, how it affects your trading freedom, and why many traders believe that a 10% static drawdown offers more real flexibility than larger but moving limits.

By the end, you’ll understand how to evaluate drawdown systems, what “largest drawdown” truly represents, and how trader-friendly prop firms like MasterFunders structure their risk limits to support consistency and long-term success.

What Is Maximum Drawdown in Prop Trading?

In proprietary trading, maximum drawdown refers to the largest amount of loss your trading account can experience before breaching the firm’s rules. It defines how much risk you are allowed to take and how far your account balance can drop before you fail the challenge or lose funding.

Think of it as your total cushion for error. If a prop firm gives you a 10 percent maximum drawdown on a $100,000 account, you can never let your balance fall below $90,000. Once that level is hit, the account breaches, regardless of how much profit you made earlier.

How Prop Firms Use Maximum Drawdown

Every prop firm sets its own drawdown rules to control risk and ensure traders use proper money management. Some offer smaller limits for tighter discipline, while others promote “larger drawdowns” to attract traders who prefer more flexibility.

However, a larger drawdown doesn’t always equal more freedom. The real impact depends on whether the limit is static, trailing, or equity-based:

- Static drawdown stays fixed from the start, giving traders consistent breathing room.

- Trailing drawdown moves upward as your balance or equity grows, reducing your cushion after profitable trades.

- Equity-based drawdown is the strictest form, as it factors in open trades and unrealized profit and loss in real time.

That’s why when traders search for a prop firm with the biggest drawdown, what they actually want is a setup that provides usable drawdown, not just the largest number on paper.

Why a 10% Static Drawdown Offers More Real Freedom Than a Higher Trailing Limit

At first glance, a 12 or 15 percent drawdown might seem more generous than a 10 percent limit. But the type of drawdown determines how much of that percentage you can actually use.

A 10% static drawdown gives you the same maximum loss allowance from start to finish. The line never moves, even if your account grows. That means every dollar of your profit becomes additional room to maneuver.

By contrast, a 12% trailing drawdown may look larger, but it can tighten quickly as your equity rises. After a strong trading streak, the loss limit moves up, reducing your safety buffer. Even a normal pullback can push you below the new threshold, ending the challenge even though you are still net profitable.

Why Static Drawdown Feels Larger in Practice

- It’s predictable: You know your limit from day one.

- It’s stable: Profits don’t reduce your available drawdown.

- It’s realistic: It mirrors how professional traders manage accounts with fixed risk budgets.

This is why many traders prefer prop firms that use static drawdown instead of trailing models. A 10 percent static system often gives more real flexibility than higher trailing options that adjust daily or intraday.

MasterFunders, for example, applies a 10% static drawdown on all challenges and funded accounts. While not the highest number in the industry, it provides consistent, transparent, and trader-friendly risk limits that don’t change as your balance grows.

How Prop Firms Calculate Drawdown Limits

Every prop firm defines its drawdown rules slightly differently. Some use balance-based systems that track only closed trades, while others use equity-based systems that include open trades and unrealized profit or loss. Understanding how your firm calculates drawdown is crucial because it determines how much real space you have to trade.

Balance-Based Drawdown

A balance-based drawdown measures only closed trades. Your open trades do not affect the drawdown limit until they are closed.

This model is the most transparent and trader-friendly because it allows positions to fluctuate naturally without triggering early breaches.

Example:

You start with $100,000 and a 10% static drawdown. The maximum total loss allowed is $10,000.

For daily drawdown, MasterFunders calculates it from your previous end-of-day balance or equity, whichever is higher.

This means your daily limit remains fixed until the next trading day’s close, giving you clear boundaries while protecting gains.

Unrealized (floating) losses during the day don’t cause an immediate violation unless they exceed the daily or max limits when the day closes.

MasterFunders uses fully static drawdown rules.

This setup gives traders more breathing room to manage trades, hold through normal pullbacks, and focus on strategy instead of worrying about equity fluctuations during open positions.

In practice, it offers more freedom than many firms that advertise “larger” drawdowns but reduce flexibility with trailing or equity-based systems.

Equity-Based Drawdown

An equity-based drawdown is stricter because it includes open trades and floating P&L (profit and loss). The system monitors your equity in real time.

If a trade moves temporarily against you and reduces your equity below the allowed drawdown limit, the account breaches immediately, even if the trade would later recover.

Example:

You start with $100,000 and a 12% trailing equity drawdown. Your equity rises to $110,000, but the drawdown now trails up to $97,000.

If a few open trades pull your equity below $97,000, the account fails — even though you are still net profitable overall.

This model is common in firms that promote larger percentages but use equity tracking to maintain tighter control. On paper, it looks like a “larger drawdown,” but in reality, traders can use far less of it.

Why Traders Value Usable Drawdown Over Large Percentages

When traders look for a prop firm with the largest drawdown, what they are really asking for is more usable drawdown…space that lets them execute their strategy without constant fear of breaching limits.

Usable Drawdown Is About Freedom, Not Just Numbers

A 10% static drawdown might offer more freedom than a 15% trailing drawdown because:

- It does not move with profits.

- It is based on balance, not equity.

- It provides a fixed limit that traders can plan around.

This predictability helps traders size positions properly, manage risk consistently, and focus on decision-making rather than micro-managing rules.

Trader Psychology and Confidence

Drawdown flexibility also affects trader psychology. When limits move constantly, traders tend to:

- Close trades early to protect equity.

- Reduce trade size unnecessarily.

- Avoid setups that require patience or larger stop-losses.

A static drawdown removes that anxiety. It gives traders a clear boundary that never shifts, leading to calmer decision-making and better performance over time.

MasterFunders’ Approach

MasterFunders applies a 10% static drawdown, no trailing limits, and no consistency rules.

This structure gives traders realistic space to trade, hold positions through normal pullbacks, and recover from small losses…all without worrying that a floating trade will suddenly invalidate their progress.

In practice, this offers more freedom than many firms that advertise “larger” drawdowns but reduce trader flexibility through trailing or equity-based rules.

The Takeaway: A Large Drawdown Should Mean Real Flexibility

When searching for a prop firm with the largest drawdown, the goal isn’t to find the biggest number. It’s to find usable risk that lets you trade confidently and realistically.

A 10% static drawdown provides stable, predictable space to manage trades, recover from small losses, and grow your balance without worrying about hidden rules or sudden trailing limits.

Why It Matters

- Predictable risk: The limit stays fixed from the start of the challenge.

- True flexibility: You can focus on execution, not the technical details of equity tracking.

- Psychological stability: Fewer surprises lead to calmer, more confident trading.

Firms that combine static drawdown with no consistency rules are often considered the most trader-friendly because they mirror how real capital allocation works in professional trading environments.

Trade Confidently with Transparent Drawdown Rules

If you want to trade with a clear, reliable risk limit, look for prop firms with static drawdown rather than trailing or equity-based systems.

A 10% static drawdown is one of the most balanced setups available, large enough to provide breathing room while still encouraging disciplined trading.

MasterFunders follows this model across all its challenges:

- 10% static drawdown (no trailing)

- No consistency rule or hidden restrictions

- Refundable evaluation once you pass

- Fast payouts and transparent account management

This structure gives traders a fair environment where skill, not rule complexity, determines success.

👉 Explore MasterFunders Challenges

Frequently Asked Questions

What is the largest drawdown in prop trading?

The largest drawdowns offered by prop firms typically range from 8% to 15%. However, the type of drawdown matters more than the number. A 10% static drawdown often provides more real flexibility than a higher trailing or equity-based limit.

What does a 10% drawdown mean in a prop firm challenge?

A 10% drawdown means you can lose up to 10% of your account balance before breaching the rules. For a $100,000 account, that’s a $10,000 loss limit. Once your balance drops below $90,000, the account fails.

What’s the difference between static and trailing drawdown?

A static drawdown stays fixed from your starting balance, while a trailing drawdown moves up as your equity increases. Trailing systems can feel more restrictive because your available room shrinks after profitable days.

Do larger drawdowns make prop firms easier to pass?

Not always. A firm advertising a 12% or 15% trailing drawdown may still be harder to pass than one offering a 10% static limit. The key is how the drawdown is calculated — static models give traders more consistent breathing room.

Which prop firm has the largest realistic drawdown?

Several firms advertise higher drawdowns, but MasterFunders provides one of the most balanced setups with a 10% static drawdown that does not trail or tighten. This gives traders consistent space to trade without hidden restrictions.

Are static drawdowns better for professional traders?

Yes. Professional traders prefer static drawdowns because they mirror institutional risk management — fixed limits, no trailing adjustments, and full control over open positions.