Prop trading is growing fast in Nigeria. More traders are joining global firms to trade bigger accounts without risking their own money.

With Nigeria’s strong fintech systems like Opay and PalmPay, joining a prop firm has never been easier.

In this guide, you will learn how prop trading works in Nigeria, how the Central Bank of Nigeria (CBN) views it, and how to get started with MasterFunders using local payments and fast payouts.

Why Nigeria Is Growing Fast in Prop Trading

Nigeria is now one of the biggest retail trading markets in Africa. Young Nigerians are learning forex, crypto, and funded trading because they want better income options and more freedom.

Here are a few reasons why prop trading is booming:

- Strong fintech support: Apps like Opay, PalmPay, and local bank transfers make payments easy and fast.

- Trading hours that match global markets: Nigeria’s time zone fits perfectly with the London and early New York trading sessions.

- Growing trader community: Online groups and Discord servers help traders learn and share ideas.

- Access to capital: With prop firms, Nigerians can trade large accounts even if they start small.

MasterFunders supports Nigerian traders with both evaluation challenges and instant funding options. Traders can start with as little as $2,500 and scale up to $400,000 by following the rules.

Is Prop Firm Trading Legal in Nigeria?

Yes. Prop trading is legal in Nigeria when you follow the rules set by the Central Bank of Nigeria (CBN).

In December 2024, the CBN released the new Nigeria FX Code, which sets out how forex activities should be done. The code supports an open and transparent market where both institutions and individuals can take part safely.

Prop trading is not the same as forex brokerage.

- Brokers handle client deposits and are directly regulated by CBN.

- Prop firms use company capital and let traders manage it under strict rules.

That means when you trade with MasterFunders, you are not sending investment funds to a broker. You are joining an evaluation model that follows transparent funding principles similar to the ethical and risk standards described in the FX Code.

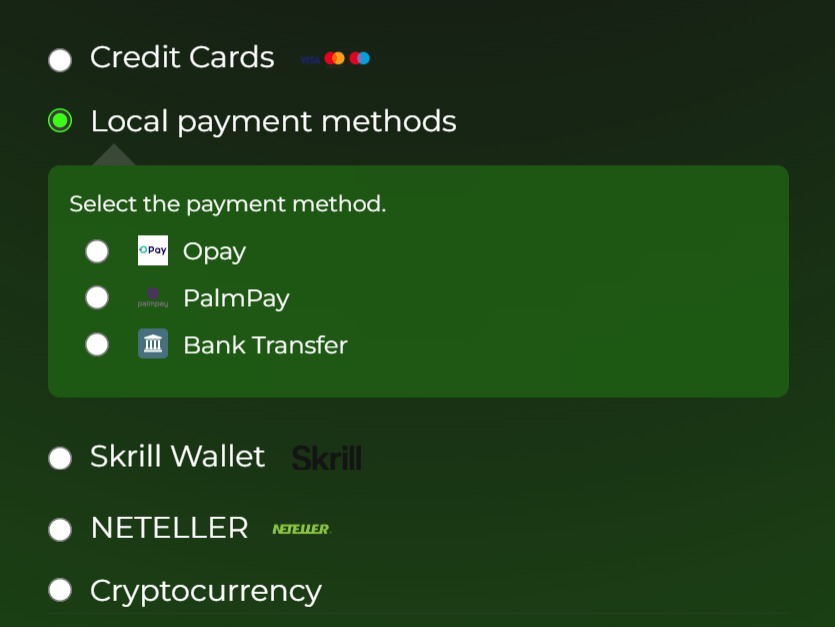

The CBN also encourages traceable and verified payments, which is why MasterFunders accepts Opay, PalmPay, bank transfer, credit card, Skrill, Neteller, and crypto for Nigerian users. These channels align with anti-money-laundering (AML) and KYC standards in the code.

If you trade responsibly, follow the rules, and use official payment methods, trading with a global prop firm is fully allowed under Nigerian regulations.

How Funded Accounts Work for Nigerian Traders

A funded account lets you trade a large balance provided by a prop firm. You trade the firm’s money, keep a share of the profits, and follow clear rules to protect the account.

At MasterFunders, Nigerian traders can choose between different challenges based on their goals:

- Core Challenge – 8% profit target, 5% max daily loss, refundable fee

- Lite Challenge – 5% target, easier rules for slow and steady traders

- Speed Challenge – one-step evaluation for faster funding

- Instant Funding – skip the challenge and start trading live after payment

Every trader follows the same structure:

- Start small with a demo or evaluation.

- Trade by the rules (drawdown, risk, profit target).

- Pass the test to get a funded live account.

- Withdraw profits while keeping your share.

This system works well for Nigerian traders who have strong discipline but limited access to trading capital. It rewards skill and consistency instead of luck.

👉 Example:

If you start with a $10,000 evaluation, you can trade up to that amount. If you earn $800 profit while following the rules, you pass the challenge. Then you can move to a funded account with payouts up to 90% profit split.

Platforms Nigerian Traders Use

At MasterFunders, the trading platform is Match-Trader, a newer, more powerful platform made for funded traders.

Here is why Match-Trader works well in Nigeria:

- Light and fast: It runs smoothly even with slower internet or mobile data.

- All-in-one dashboard: You can see your open trades, balance, profit targets, and drawdown in one place.

- Mobile-friendly: Many Nigerian traders trade on their phones, and Match-Trader is built for that.

- Real-time tracking: Your daily loss, total loss, and progress toward funding are updated instantly.

Match-Trader gives Nigerian traders the same experience as professional funded traders in the US or UK. You can trade forex, indices, metals, and crypto all in one account.

👉 It helps new traders learn discipline early, which is a key part of becoming profitable.

Payments That Work in Nigeria (and What to Avoid)

One of the biggest challenges for Nigerian traders is finding prop firms that support local payments. Many international firms only accept credit cards or crypto, which can be difficult to use in Nigeria.

MasterFunders is one of the few firms that supports local Nigerian payments:

✅ Opay – fast mobile wallet used by millions of Nigerians

✅ PalmPay – easy bank and wallet integration

✅ Direct bank transfer – pay from any Nigerian bank

✅ Credit or debit card – Visa and Mastercard

✅ Skrill and Neteller – for international e-payments

✅ Crypto payments – for traders who prefer USDT or BTC

These options make it simple to start or renew a challenge from Nigeria. All payments are verified and follow CBN FX Code standards for transparency and security.

⚠️ Avoid:

Do not send money to Telegram “agents” or unverified sellers offering “cheap challenges.” CBN rules now require traceable and verified payments, so this keeps your account safe.

Taxes and Payouts for Nigerian Traders

When you earn from a funded account, your payout is treated as income, not salary. In Nigeria, traders are expected to keep records of payouts, withdrawals, and invoices for tax reporting.

Here are a few simple steps to stay compliant:

- Keep every payout record from MasterFunders. Save your payment statements and transaction IDs.

- Classify it as freelance or business income. This helps you report it correctly when filing taxes.

- Keep track of your conversions. If you receive payouts in USD, record the exchange rate on the day you withdraw.

- Use traceable payment channels. Withdrawals made through Opay, PalmPay, Skrill, or direct bank transfers are safer and easier to report.

MasterFunders processes payouts fast. You can request your first payout three days after you start trading live. After that, you can withdraw profits anytime you want, even daily. All payout requests are sent within 24 hours once you make the request. Nigerian traders usually get paid through Skrill, Neteller, crypto, or direct bank transfer, depending on what works best for them.

How to Join MasterFunders from Nigeria

Joining MasterFunders from Nigeria is simple. The whole process is online and designed to work with local payments and Nigerian time zones.

Here is how to start:

- Create your account: Visit the official MasterFunders website and sign up.

- Choose your path: Pick between an evaluation challenge or instant funding.

- Select payment method: Pay with Opay, PalmPay, bank transfer, card, Skrill, or crypto.

- Trade under the rules: Follow your drawdown, daily loss, and profit target.

- Pass and scale: Once you pass, you become a funded trader and can scale up to $400,000.

You can also join the MasterFunders Discord community to take part in trading competitions. Nigerian traders can compete for free challenge entries and prizes like $25K Core Challenges.

To join:

- Submit your MasterFunders account email and consent form.

- Access your competition account directly in the dashboard.

- Trade during the contest week to show your skills.

These competitions are one of the fastest ways to earn free challenge entries and prove your ability without risk.

Nigeria-Specific Advantages for Funded Trading

Nigeria has unique strengths that make it a great place for prop trading.

Here are a few reasons why Nigerian traders have an edge:

- Local payment systems: With Opay, PalmPay, and bank transfers, joining and withdrawing is easy and fast.

- Perfect trading hours: Nigeria overlaps with the London and early New York sessions, the most active times for forex.

- Large trader community: More Nigerians are learning forex and building prop trading groups online.

- Affordable entry: Evaluation fees are lower compared to the average salary, making prop trading one of the best low-cost side incomes.

- Scalable funding: At MasterFunders, you can grow from $10K to $400K with consistency and good risk control.

With the CBN FX Code now promoting transparency and ethical forex activity, Nigerian traders can confidently participate in funded trading. Using traceable local payments and trading with discipline makes prop trading a safe and legal way to grow in 2025.

Final Takeaway

Prop firms are giving Nigerian traders a new way to earn without using their own money. With MasterFunders, you can trade funded accounts, get paid within 24 hours after your payout request, and scale up to $400,000, all while paying through local Nigerian systems like Opay, PalmPay, and bank transfer.

The forex market in Nigeria is regulated and open for disciplined traders. By using safe payment methods and following prop firm rules, you can trade global markets confidently from Lagos, Abuja, or anywhere you live.

Remember:

Success in funded trading is not about luck. It is about discipline, consistency, and risk control.

If you are ready to level up your trading career, start today with a MasterFunders Evaluation Challenge or a demo to practice under real conditions.

👉 Apply now and trade with real prop firm capital from Nigeria.

FAQs

Is prop firm trading legal in Nigeria?

Yes. Prop trading is legal in Nigeria when you follow the rules set by the Central Bank of Nigeria (CBN). Prop firms do not take client deposits like brokers. You trade company capital under clear risk rules. Always use official payment channels like Opay, PalmPay, or bank transfer for safety.

Can I pay for a prop firm challenge using Naira?

Yes. MasterFunders supports local Nigerian payment options including Opay, PalmPay, and direct bank transfer. You can also pay with Skrill, Neteller, credit card, or crypto. Payments are automatically converted to USD at checkout.

How are payouts handled for Nigerian traders?

You can receive payouts through Skrill, Neteller, crypto, or bank transfer.

Your first payout can be requested 3 days after you receive your funded account.

After that, you can request payouts anytime you want, even daily (on demand).

All payout requests are processed within 24 hours from the time the trader submits the request.

Always keep your payout records for tax and compliance purposes.

What is the best time to trade in Nigeria?

The best time is during the London and early New York sessions, from 2:00 PM to 8:00 PM Nigerian time. This is when liquidity is high and spreads are tighter.

Does MasterFunders offer free accounts in Nigeria?

No. The free demo challenge is for practice only and does not pay profits. You can, however, win free challenge entries by joining MasterFunders Discord competitions. Real funded accounts are available after you pass a paid or refundable evaluation.

What is the difference between static drawdown and trailing drawdown?

MasterFunders uses static drawdown, which is trader-friendly. It does not move as your profit grows, unlike trailing drawdown that follows your equity. Static drawdown gives you more room to trade safely and hold longer positions.

Can I scale my funded account in Nigeria?

Yes. You can scale your MasterFunders account by +25% every 3 months if you trade profitably. The maximum funding level is $400,000.