Static drawdown in prop trading is a fixed maximum loss limit that never changes, no matter how much profit you make. Unlike trailing drawdown, which moves up with your balance, static drawdown stays the same from the start. This makes it simple, transparent, and more trader-friendly. At MasterFunders, all funded accounts use static drawdown rules to give traders clear risk limits and fair conditions.

What Is Static Drawdown?

Static drawdown (also called absolute drawdown) is a fixed risk limit in a trading account. It sets the lowest point your balance can reach before the account is considered failed. Unlike trailing drawdown, it does not move as your profits grow.

Example: If you start with $100,000 and your static drawdown is $5,000, your account can never fall below $95,000. Even if you grow your account to $120,000, the drawdown stays at $95,000.

This makes static drawdown simple, clear, and predictable. Traders always know the maximum loss allowed from day one.

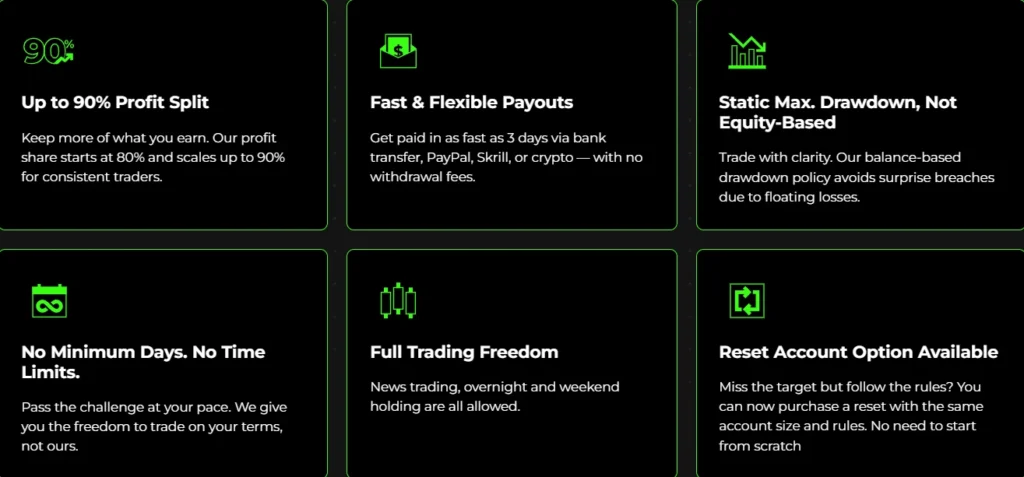

👉 At MasterFunders, all accounts use static, balance-based drawdown because it’s fairer and gives traders breathing room compared to trailing equity-based rules.

How Static Drawdown Works in Prop Firms

When you join a prop firm challenge or get instant funding, your account comes with risk rules. The most important one is maximum drawdown. With static drawdown:

- Your loss limit is locked to your starting balance

- The number never moves up or down with profits

- You can trade freely without worrying about your profit cushion shrinking

Example in Practice

- Account: $50,000

- Static Drawdown: $2,500

- Failure Level: $47,500

Even if your balance grows to $60,000, the lowest allowed remains $47,500. You can use profits for more trades without fearing that the drawdown will “chase” your equity.

This makes static drawdown easier to manage, especially for swing traders or those holding positions overnight.

Static vs. Trailing Drawdown (Why Traders Prefer Static)

The main difference between static and trailing drawdown is how the limit moves:

- Static Drawdown → Fixed at the start, never changes

- Trailing Drawdown → Moves up as profits grow, locking in highs

Why Static Is Better for Traders

- Freedom to Hold Profits: With trailing drawdown, profits raise the floor and reduce your cushion. Static lets you keep your risk buffer no matter how much you earn.

- Less Stress: You don’t have to worry about every swing eating into your safety margin.

- Fairer Scaling: Profits work in your favor, not against you.

- Trusted by Funded Traders: Most experienced prop traders prefer static because it rewards consistency instead of punishing growth.

👉 That’s why MasterFunders offers only static drawdown accounts. We want traders focused on discipline, not on surviving unfair rules.

Static Drawdown Example

Let’s say you get a $25,000 funded account with a 10% static drawdown:

- Starting Balance: $25,000

- Max Loss Allowed: $2,500

- Failure Level: $22,500

Now imagine you grow the account to $30,000. Your drawdown floor still stays at $22,500. That means you now have $7,500 of cushion before breaking rules.

This is why static drawdown is considered fair. Your profits give you more room to trade, not less.

Benefits of Static Drawdown

Static drawdown comes with big advantages for traders:

- Predictable Risk – You know your loss limit on day one.

- Easier Planning – No moving targets, so you can size positions with confidence.

- Freedom for Strategies – Works well for swing trading, scalping, and holding trades overnight.

- Less Stress – You don’t need to close trades too early just to protect a shrinking cushion.

- Better Psychology – Clear rules help you stay calm and focused.

At MasterFunders, these benefits are the reason we use balance-based static drawdown across all evaluations and funded accounts.

Static Drawdown in Prop Firm Accounts

Different prop firms use different types of drawdown rules. Some use trailing, which moves up with profits, while others use static.

At MasterFunders, we use static drawdown only. This means:

- Core Challenge → Static max loss with 2-step targets

- Lite Challenge → Static rules with lower targets

- Speed Challenge → Static rules, pass in 24 hours

- Instant Funding Pro → Static limits, no evaluation needed

- Free Demo Challenge → Practice static rules with zero cost

This approach gives every trader a fair and simple risk model that does not punish profit-making.

Static vs Trailing vs Relative Drawdown

There are three main types of drawdown rules in prop firms:

- Static Drawdown

- Fixed max loss from your starting balance.

- Example: $25,000 account with 10% static = failure level stays $22,500 forever.

- Trailing Drawdown

- Loss limit moves up as your profits grow.

- Example: Start at $25,000, grow to $27,000. Your failure level rises from $22,500 to $24,300. If you lose back profits, you can break rules even while still above $25,000.

- Relative Drawdown

- Similar to trailing, but often calculated from equity (including open trades).

- Very restrictive because even floating profits can raise your limit.

👉 The key difference: Static is trader-friendly. Trailing and relative can cut traders off too early.

Why MasterFunders Chooses Static Drawdown

At MasterFunders, we believe traders should not be punished for making profits. That’s why we only use static drawdown across all accounts.

- Simple: The loss limit is clear from day one.

- Fair: If you earn profits, you keep the cushion.

- Scalable: Works with our program that grows accounts up to $400K.

- Proven: More traders succeed under static rules compared to trailing.

This is why many traders move from other prop firms to MasterFunders. Our risk system is built for traders, not against them.

Which Is Better for You?

If you value:

- Clear rules

- Freedom to swing trade or hold positions

- Less stress about giving back profits

Then static drawdown is the better option.

Trailing or relative drawdowns may look fine at first, but they often create hidden risks. Many traders fail evaluations not because of bad trading, but because of unfair trailing limits.

With MasterFunders’ static drawdown, you trade with confidence knowing your risk is fixed and fair.

MasterFunders Static Drawdown Rules in Action

Here’s how it works at MasterFunders:

- Account sizes: $5K up to $100K (scalable to $400K).

- Drawdown: Fixed static level from your starting balance.

- Example: On a $50K account with 10% static, your stop-out is $45K. Even if you grow to $70K, your limit stays $45K.

- Payouts: First payout after 7 days, then weekly or monthly.

👉 This means you can focus on trading well, without worrying about unfair equity-based rules.

Practice Static Drawdown in the MasterFunders Discord Competition

MasterFunders runs regular Discord trading competitions where traders can join for free, trade on Match-Trader, and win funded challenges. These competitions are a perfect way to practice risk management under static drawdown rules.

-

Entry is free — just register with your MasterFunders account.

-

One competition account per trader keeps things fair.

-

Rules include discipline checks like not overexposing on one instrument (max 60% margin rule).

-

Prizes include funded challenges — for example, past winners have received $25K Core Challenge accounts.

This setup gives you real-world experience with MasterFunders’ trader-friendly static drawdown, while also competing for live accounts.

👉 Want to enter? Join the MasterFunders Discord Competition.

Final Takeaway

Static drawdown is the most trader-friendly risk system in prop trading. Unlike trailing or relative drawdown, it doesn’t punish you for being profitable. Your max loss is clear from day one, and it never changes.

At MasterFunders, every account — whether Evaluation, Instant Funding, or Scaling Path — uses static drawdown. That’s why thousands of traders worldwide trust us to provide fair funding conditions.

🚀 Ready to trade with rules built for traders?

👉 Apply today for a MasterFunders account and trade with confidence under static drawdown.

FAQs About Static Drawdown

What does static drawdown mean?

Static drawdown means your maximum loss is locked to your starting balance. It never moves up or down with profits.

Is static drawdown better than trailing drawdown?

Yes, because it is simpler and fairer. With static, you always know your risk. With trailing, you can break rules even when you are profitable.

What is the difference between static and relative drawdown?

Relative drawdown follows your equity balance, including floating trades. This makes it even tighter than trailing. Static ignores all of that — only the starting balance matters.

Why do some prop firms still use trailing?

Some firms use trailing because it protects them more. But for traders, it is harder to succeed. That’s why MasterFunders stands out with static drawdown only.